What Caused the Recession ?

Debt caused the Recession.

Are We Still In Recession in 2015?

Excessive debt leads to insolvency. A growth of debt level must be accompanied by a growth of income. The US economy broke this simple rule, the result has been the Great Recession (GR). Economist Steve Keen won a respected prize among economists for predicting the GR. His explanation points exclusively to the growth of private debt. Since 1964 the “average weekly earnings” of non-supervisory workers, about 80% of the work force, has declined in inflation corrected terms by 4%, while the economy has become more productive per worker and per capita by a rate of 175%. With this background of income stagnation, what did debt do?

It expanded, especially among financial corporations and households. In his book Debunking Economics, page 336, Keen states, referring to the US Flow of Funds report from the Federal Reserve, “Such an exponential rise in the debt ratio had to break, and when it did the global economy would be thrust into a downturn that would surely be more severe than those of the mid-1970s and early 1990s . . .(page 347) The debt-to-GDP ratio, which began the post-war period at barely 50 percent, increased by a factor of 6 in the subsequent five decades to reach a peak of 298 percent of GDP in early 2009.”

He was drawing on Table D.3 from the Flow of Funds report. Looking at that report, the ten year section,1998 to 2008, these are the figures of debt growth.

Total domestic debt in ten years from 1998 to 2008 grew from $23 trillion to over $53 trillion. It increased by 76%, adjusting for inflation, while “disposable personal income” per capita increased by 21%. The key sources of debt are Government, Consumer, Non-Financial Corporate, and Financial Corporate.

The Financial Corporate sector debt increased 100% adjusted for inflation, and it's portion of total debt increased from 27% to 32% of all domestic debt (it was minuscule before 1970 as a % of GDP).

Consumer debt increased by 78% inflation adjusted, its share of total debt increased by 1%, from 25% to 26%.

Non-financial business debt increased by 65% per inflation adjustment, dropping its share from 23% to 21%.

Government debt (federal, state and local) increased debt by 53%, falling from 21% to 17% of total debt. Quite often government debt is painted as the debt villain, but this is pure ignorance in the service of politics. Put a white hat on government debt; put a dark thief's mask on financial system debt.

Between 1980 and 2008, 28 years, the economy's per capita “disposable personal income”, grew by 79%. (from BEA.gov)

Total domestic debt increased by 230%, from $10.6 trillion to $34.9 trillion.

So debt growth nearly tripled the rate of economic growth (79 times 3 = 237.).

Financial Corporate debt grew from 20.7% to 120.0% of GDP (in 2015 it’s at 85%)

Household debt grew from 50.2% to 96.6% of GDP

Non-financial business debt grew from 52.9% to 80.0% of GDP

Government (federal and state) debt grew from 38.7% to 64.7% of GDP

(I chose 2008 as the end year because financial corporate debt peaked in that year.)

I used BEA figures for GDP and Flow of Funds figures for debt components.

Conclusion: The economy grew well, increased output by almost 80% per human being, but the debt burden took off, all sectors piled on more debt relative to the size of the economy. In 1980 total domestic debt was 1.7 times greater than the annual GDP, in 2008 it was 3.7 times greater.

Keen states it was 3.98 times greater (see above). The financial system froze solid. Secretary of Treasury Paulson said it was encumbered with “negative frozen assets.” That’s a euphemism for valuable stuff wildly over-priced which no one will buy, trade or make loans on.

Debt stimulates the economy, to a point. Excessive debt breaks it down catastrophically. The role of debt in a modern economy is a crucial factor which modern economics has failed to assess. The book The Bankers’ New Clothes: What’s Wrong with Banking and What To Do About It, by Admati and Hellwig, tries to lay out some reforms so that the economy will not nose-dive again. The Dodd-Frank bill needs strong support, not the systematic dismantling we witness from the Republican Congress.

My web page, Economics Without Greed

Several recent books agree about the threat of over-lending.

From MIT Press, Systemic Risk, Crises, and Macroprudential Regulation

—- “This must-read book carefully defines systemic risk, considers all its dimensions, identifies the greatest sources of systemic risk (lending booms), and suggests a simple policy approach that avoids the pitfalls that are common in less thoughtful analyses of macroprudential regulation,” states one of the endorsements.

Between the Devil and Debt, by Adair Turner, the former chairman of England’s Financial Services Authority —-

“Between Debt and the Devil challenges the belief that we need credit growth to fuel economic growth, and that rising debt is okay as long as inflation remains low. In fact, most credit is not needed for economic growth . . .”

Claudio Borio is interviewed at INET, the Institute for New Economic Thinking, explaining the importance of macro prudential policy. “According to Dr. Claudio Borio, Head of the Monetary and Economic Department, Bank for International Settlements, one could even say that “we are all macroprudentialists now”. And yet, a decade ago, the term was hardly used. What does it mean?”

According to Borio, it denotes a systemic or system-wide orientation of regulatory and supervisory frameworks and their link to the macroeconomy.

http://ineteconomics.org/ideas-papers/interviews-talks/credit-booms-credit-busts

The movie “The Flaw” also shows the threat of growing aggregate debt in a chart. By 2007 it had reached 360% of GDP, up from 120% in 1960.

Are We Still In Recession in 2015?

And the employment rate among age 25 to 54 years old has

recovered by half, so we are half way to recovery --- after 5 and a half years!

(See here, the February 6, 2015, articles by Elise Gould, with relevant graphs.)

(See here, the February 6, 2015, articles by Elise Gould, with relevant graphs.)

The unemployment rate would be 9.0% she says, if the dropped-out workers

were counted.

9.0% unemployment IS recession.

Not since 1986 has this particular age group showed such low employment.

This age group is not affected by the baby boomer retirement event; their low

employment rate is solely an effect of the recession. And a perspective on the devastation of long term unemployment can be found at the CEPR site. From 1996 to 2008 outstanding financial debt increased by 162%,

and the economy's growth per capita grew by 24%.

Creating debt at a rate almost 7 times faster than real growth is disastrous.

When the median household savings falls by nearly 40%, when 15 million or 11% of the workforce lose their jobs in a two year period, and when the recipients of food stamps increases from 17 million in 2000 to 47 million in 2013, that is a disaster.

(see graph here)

Excessive private, not public, debt created the fatal flaw leading to the great recession.

I calculated from the Federal Reserve's Flow of Fund report, Table D3, and then adjusted for inflation. You can also note that government debt grew slower than all other sectors' debt. This Federal Reserve Graph shows the growth of the financial system outstanding debt, numbers unadjusted for inflation. And this one shows the growth of household debt.

When the median household savings falls by nearly 40%, when 15 million or 11% of the workforce lose their jobs in a two year period, and when the recipients of food stamps increases from 17 million in 2000 to 47 million in 2013, that is a disaster.

(see graph here)

Excessive private, not public, debt created the fatal flaw leading to the great recession.

I calculated from the Federal Reserve's Flow of Fund report, Table D3, and then adjusted for inflation. You can also note that government debt grew slower than all other sectors' debt. This Federal Reserve Graph shows the growth of the financial system outstanding debt, numbers unadjusted for inflation. And this one shows the growth of household debt.

Here's another comparing financial debt with non-financial corporate debt.

I also used the Measuring Worth web page where they calculate GDP per capita growth between 1996 and 2008.

Here's a graph of total private debt as a percentage of GDP. We are still around double the historical average. Between 1946 and 1976 the economy grew at a rate of

The U.S. economy grew at half its normal rate between 2000 and 2010. From Wikipedia and BEA.gov:

"US real GDP grew by an average of 1.7% from 2000 to the first half of 2014, a rate around half the historical average up to 2000.[84]" There's a chart tucked away in Bailout Nation by Barry Ritholtz showing that GDP growth during the pre-crash 2000s was generated by home loan mortgage borrowing, called 2nd mortgages.

Christian Weller provides a monthly snapshot of the economy at the Center for American Progress.

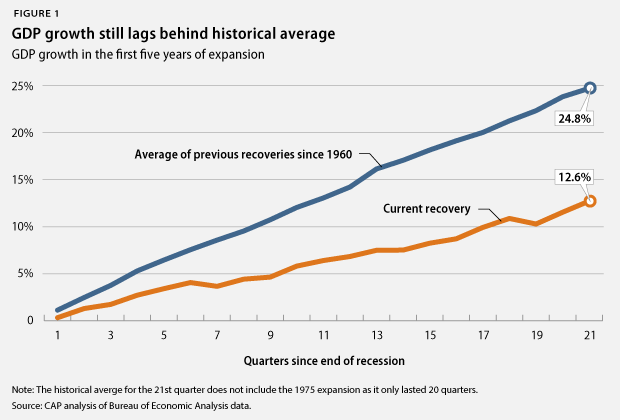

This comes from the January report: "Household debt equaled 102.5 percent of after-tax income in September 2014, down from a peak of 129.7 percent in December 2007." And this graph showing our present recovery vs. other recoveries:

recovery is about a third, not a half, of all previous recoveries:

Home Mortgage Crisis Still Unfolding

Dan Alpert at Economonitor, March 6, 2015, writes about the wrongly perceived recovery in housing.

It's an important article showing the impending deflationary pressures on the economy.

One must link to his Westwood Capital web page to see the entire presentation. The graph

on page 12 tells a powerful story of deflation, especially combined with the thesis of his analysis.

Here's an article about the failure of the Obama Administration effort to save homeowners (from a recent American Prospect issue). This is an example paragraph from the article:

"The most direct and effective policy solution to stop foreclosures is to allow bankruptcy judges to modify the terms of primary-residence mortgages, just as they can modify other debt contracts. This is known in the trade as “cramdown,” because the judge has the ability to force down the value of the debt. The logic of bankruptcy law reduces debts that cannot be repaid in order to serve a broader economic interest, in this case enabling an underwater homeowner to keep the house. Liberal lawmakers believed the threat of cramdown would force lenders to the table, giving homeowners real opportunities for debt relief. Wall Street banks were so certain they would have to accept cramdown as a condition for the bailouts that they held meetings and conference calls to prepare for it."

Housing Crisis Myths

Here are the Ten Myths from Jennifer Taub's book Other People's Houses from the last chapter :

1. There has been no official bipartisan consensus on the causes of the financial crisis.

Carl Levin (D) and Tom Coburn) investigated and agreed on the causes, see here.

2. The financial crisis was an accident without human causes.

2. The financial crisis was an accident without human causes.

Steve Keen explains in his book Debunking Economics that he received

the (Paul) Revere award for his prescient forecast of the economic freefall.There were 94 other economists in the running for the award, and 5,000 who voted

in the award. Read the article.

3. The financial crisis was brought about because the Community Reinvestment Act of 1977 forced banks to lend to people with low incomes who could not afford to pay back their mortgages.

This is the conclusion of most Republicans, and it is fantasy.

4. The giant government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, caused the financial crisis because he government pushed them to guarantee mortgage loans to people with low incomes as part of their public housing mission.

4. The giant government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, caused the financial crisis because he government pushed them to guarantee mortgage loans to people with low incomes as part of their public housing mission.

Fannie and Freddie were private enterprises selling their stock shares on the NYSE.

The FCIC concluded they were acting out of self-interest, not government pressure. 5. Mistakes were made, but there was not widespread fraud and abuse throughout the financial system.

Jennifer Taub's book and others will convince you of fraud.

6. The financial crisis was caused by too much government regulation.

6. The financial crisis was caused by too much government regulation.

Most people realize that the system was poorly regulated.

7. Nobody saw it coming.

7. Nobody saw it coming.

See note #2 about the Revere Award.

8. The financial crisis was unavoidable. And financial crises of this magnitude are inevitable.

8. The financial crisis was unavoidable. And financial crises of this magnitude are inevitable.

The Federal Reserve is charged with oversight sufficient to quell over-speculation.

9. The Dodd-Frank Act has ended "too big to fail".

9. The Dodd-Frank Act has ended "too big to fail".

The six largest banks are larger than before their self-destruction.

10. The bankers are the victims of greedy homeowners who borrowed money and did not pay it back.

10. The bankers are the victims of greedy homeowners who borrowed money and did not pay it back.

When debt increases 7 times faster than growth over a 12 year period, 1996 to 2008; when home price jump by 70% nationally over a four year period, 2002 to 2006, banks are not ignorant observers, they are perpetrators. They immediately sold most of their loans as

securitized assets.

securitized assets.

Taub's book is masterful, I nominate her for the Supreme Court. It is also very complicated and detailed. The last page of her book quotes Bank of America CEO Brian Moynihan testifying to the FCIC,

"Over the course of this crisis, we as an industry caused a lot of damage. Never has it been clearer how mistakes made by financial companies can affect Main Street, and we need to learn the lessons of the past few years."

surprising that so many ignore this as the main cause. Economist Steve Keen has

placed his analysis on it in his book Debunking Economics. From page six, ". . . the

never ending crisis . . . was no 'Black Swan.' Its inevitability was obvious to anyone

who paid attention to the level of debt-financed speculation taking place, and considered what would happen to the economy when the debt-driven party came to an end."

_______________________________________________

POVERTY RAGES

Paul Buchheit has been writing the nation's best journalism. He explains in this February 2015 article the endemic poverty in the wealthiest nation. He cites a study showing that "almost two-thirds of Americans didn't have savings available to cover a $500 repair bill or a $1,000 emergency room visit."

The average household income, pre-tax and pre-transfer, is $93,000 a year (see CBO report here). The average savings per household is around $650,000 (see Federal Reserve report, page 2, here) -- and almost 2 in 3 live in households that cannot pay a $1,000 emergency room visit. !!!

Should it surprise us that the suicide rate among age 40 to 64 group has increased by 40% since 2000?

Read the article here.

__________________________________

Read the article here.

__________________________________

LOW WAGES

I made this comment on one of Elise Gould's articles about employment, cited above.

"The Social Security Administration report on wages for 2013 says that 40% of workers earn less than $20,000 a year. The National Jobs for All Coalition shows that 12% of all workers work full-time and year round for under $23,500 a year, the poverty level for a family of four. 40% of Workers Earned Just 4% of all Income in 2013

The combined or collective income of all 61 million workers who earned less than $20,000 in 2013 is about 4% of the total national income. Again 40% of the workers earn only 4% of all the income our economy generated.

It's not complicated to figure it out. Add the incomes at the SSA report to get the $504 billion in income going to the lowest earning 40%, then go to the BEA.gov / personal income interactive site to find total personal income for 2013, $14.167 trillion. Then divide the numbers for a percent of total. Even if we take the total income recorded by the Joint Committee on Taxation for 2014, $12.7 trillion, the percentage does not really change much (see here for the JCT, page 30). Or look at the EPI table 2.4, see here, and find that wage income amounts to 54% of total income.

Something should go off in your mind when you read this.

No comments:

Post a Comment