Reflating Demand --- Reflating Consumer Spending Power ---

What is reflation of demand? Who believes in it? As old as J.M. Keynes, it means some sector of the commonwealth -- either business, consumer, or government -- has to re-fire purchasing demand to increase employment to its former level of sufficient employment. This is the strategy Keynes urged upon Roosevelt in an open letter published in the New York Times in January of 1933 before Roosevelt was sworn in. (View letter and note section 5.) Between 1933 and 1937 the unemployment rate dropped from 25% to 9.6% according to this article by Marshall Auerback.

I viewed the recent video at TRNN.com. (Or at original site, http://econ4.org/films) Take a minute to view it. The scholars mostly from University of Massachusetts, Amherst, describe the essential remedy to our sagging economy. I added the following comment:

"We need to reflate demand," states one economist, summarizing the problem.

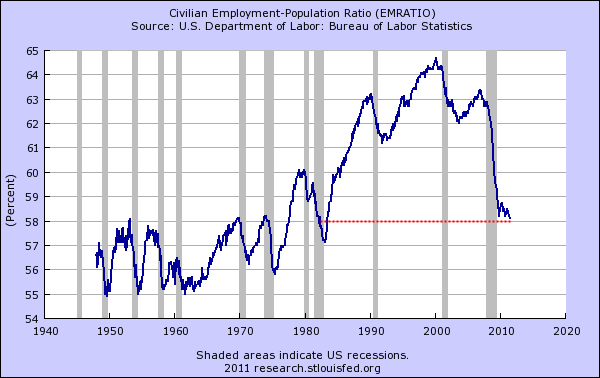

Consumer purchasing power took a strong hit with the Recession. 15 million people were permanently displaced from work, 11% of the work force, or 1 out of every 9 workers. Only half were re-employed. The BLS states: ". . . U.S. employment had declined by 8.8 million from its prerecession peak." By November 2012, 34 months since its trough or maximum drop, employment has added 4.6 million jobs, which is only about 500,000 ahead of normal labor participation and population growth. At this rate of job growth I calculate that in 33.4 years, around May 1, 2044, the economy will recover its pre-recession employment to population ratio. The net worth of the median household fell by almost 40%, from $126,000 to $77,800 as housing value sunk. Consumer purchases comprise about 80% of economic activity.

An Economy Operating Well Below Potential

An economic depression is a self-inflicted waste of human resources resulting in high unemployment; perhaps $3 trillion of output has been unrealized because of missing purchasing power. State of Working America presents some graphs showing this loss of potential output, $775 billion per year. A more recent essay from EPI states, "U.S. economic output is currently depressed $973 billion below potential economic output --". The shortfall in output is 5.8% below full potential, and for 4 full years the economy has been below 5% of full output. And finally, Dean Baker states, "And of course the United States is also losing close to $1 trillion in output each year, with close to 23 million unemployed, underemployed or out of the workforce altogether because of poor job prospects."

I put the unemployed and under-employed rate at 18.7% or 29 million, and the National Jobs for All Coalition puts it at 16.7% or 27.0 million for November, 2012. and the BLS places it at 14.4% or 22 million. I make a far higher estimate of the "discouraged" and "marginally attached" workers. The National Jobs for All Coalition, a full employment advocacy group, makes good argument for its number, if you are interested.

Inequality of Income

Since 1979 the lower-earning 80% of households (94 million of 118 million households) has lost 10% of its income share, almost all of which went to the top-earning 1% (check the CBO report, page xiii and note the graph on the front cover). The top 1% of households increased its portion from 8% to 17%, post government transfers and taxes. If we had the same distribution as 1979 there would be no depression/recession, each of the 94 million households of the lower-earning 80% would have $11,000 more income each year.

That would only return us to the income distribution levels of 1979.

Presently, the combined total personal incomes of 4.3% of the 155.9 million taxpayers (all with incomes over $200,000 per year) in 2012 was $3.258 trillion. This amount is greater than the combined wage incomes of the lower-earning 86% (129 million workers) of the 150 million wage and salary earners of 2010, or $3.185 trillion. An easier way to remember this is to say: 1 out of 25 taxpayers (4%) has a greater total income than the combined wage incomes of 22 out of 25 wage earners (86%). Or all the wage income of workers earning less than $70,000 a year is less than the combined total income of the top 4% of taxpayers.

An Uncomfortable Fact ---

The Economy Grows 6 Times Faster than Workers' Income ---

Workers' Income Tank during the past 21 years

The U.S. median wage income, inflation adjusted, for all workers has grown by 5.6% between 1990 and 2011, while the inflation adjusted (real) per capita GDP, economic output of the economy, has grown by 33%. Adjusted for inflation the median income for all workers in 1990 was $25,537 and in 2011 it was $26,965. In other words, a given worker is creating 33% more value over a 21 year period but receiving only 6% more income. The "Real GDP/capita" grew from $36,000 to $48,000 in that period. See Social Security Administration reports on Wage Income over the years 1990 to 2011 and tally the median income growth and adjust for inflation, and view the St. Louis Federal Reserve graph on "Real GDP/capita" growth. The mean average wage income growth from 1990 to 2011 (not the median wage income growth -- 5.6% growth -- that I mention above) has increased by 16.5%, about half as fast as overall real per capita GDP growth. So, one may ask, if the overall economy is growing by 33% per human, how is it possible that average wages grow only by 16.5%? One should look to other sources of income, dividends, capital income of all types. See my blog essay of May, 2012, which I admit is as clear as mud, but the broad outlines are there.

The system is broken. I suspect most readers will, and should, balk at the above claim. I suggest you do the long addition problem at the Social Security Administration page on wage income, and compare it with taxpayers' market income at the Joint Committee of Taxation figure (see page 28). I did not fudge the numbers. Also check the Table 2.4 - Income - at State of Working America, to see, that among 117 million households in 2007 the wage income of the lower-earning 80% equals 27.3% of all income, while the total income of the top 6% equals 31.9% of all income. I find this complicated and perhaps too demanding for "blog" information, and also I am comparing households' incomes with taxpayers' market income and workers' wage incomes -- three disparate groups, though not at all mutually exclusive. The trend and broad outlines are all the same very clear.

A recent book explores Wage Policy, Income Distribution and Democratic Theory, by Oren Levin-Waldman (Routledge, 2011). The review states, a wage policy "can accelerate aggregate demand, boost employment, and spur economic development. But such a policy also has another, equally vital consequence: it can reduce income inequality in a way that enhances personal autonomy, gives meaning to the notion of personal responsibility, and fortifies democracy by strengthening opportunities for political and civic participation." In all, wage policy is central to core values drawn from the Age of Enlightenment reflected in the U.S. Declaration of Independence. When Abraham Lincoln was a young man he earned income rowing a small boat transporting travelers to a waiting steam-driven river boat. When his first customers tossed some coins into his skiff he said a whole new world opened up to him, as he had been used to trading strictly by barter. Income is liberating and empowering. Lack of income is the opposite.

40% of Workers Earn 2% of Total Income

The most recent Social Security Administration report appeared last month, November 2012, and it shows 40% of all US workers earned in wages less than $20,000 in 2011, according to the annual Social Security Administration report Wage Statistics for 2011. See the report. Collectively the lower earning 40% of workers earn $198 billion which is 3.2% of all U.S. wage income which is also only 1.7% of all U.S. personal income, about. (Total income figure, $11.468 trillion, comes from the Joint Committee on Taxation, page 28, linked to above) That's 61 million workers out of a total of 150 million earning less than 2% of all income. I did not forget the exclamation point.

To contradict the last paragraph, I looked up the total wage income for the lower-earning 40% of households, at the EPI's State of Working America (see the table). It shows their combined income amounts to 13.0% of all wage income, or 7% of total personal income, not my claim of 1.7%. Household vs. Wage Earners -- many jointly filed income tax reports boost the percentage for the lower-earning 40%, both households and workers. Confusion aside, 1.7% or 7% -- it's a broken system.

I show more details and references later in this essay. But suffice it to say, the labor-rewards market is broken and socially pernicious (has a harmful effect), and we need higher taxation on the top-earning households, and a policy of increasing incomes at the lower-earning levels (see my essays of January 2011 and February 2011). The recent August 2012 publication of the book Take Back the Center by Peter Wenz makes this case, and you can read a little about it here and here.

The Quicksand Economy

To reflate purchasing demand involves rebalancing the distribution of income and wealth. In the lengthy next essay here, at this blog, I quote a NYTimes columnist who shows that wage and salary income are at the lowest portion of total income since 1929, total compensation is down to levels not seen since 1954, and corporate profits as a percentage of GDP are at their highest levels ever. (See this December 2012 article stating the same.) This means typical workers cannot purchase the value of what they are making, therefore they are laid-off and join the unemployed, and the death spiral continues. The employment to population ratio dropped during 2008/2009 and has stagnated at the 1980s level for over 4 years, meaning that if we had the employment rate of 2000 applied to today, we would have not 143 million but 157 million daily workers (10% more than today) and the labor force would be 163 million, not 155 million, and the unemployment rate would be 4.3%. The U3 unemployment rate is not decreasing -- rather, more people are dropping out of looking for work, and labor market growth is just slightly faster than population growth. At the rate of employment growth (22,000 jobs created per month in excess of population growth) of the last 2 years, 2011 and 2012, it will take 33.4 years, or 401 months, not until May of 2044, to regain the employment to population ratio we had in 2007, and longer to achieve the employment to population ratio of 2000. This is not the place to demonstrate my calculations, but the employment growth for the past 2 years has been only 22,000 per month greater than historical workforce participation growth. The alternative to reflating is to wait years, perhaps decades, before debt levels and savings levels allow purchasers to reflate economic activity and employment levels. I explain this (with excruciating detail) in my next blog entry, just below.

_______________________________________________________________________

My Letter to the New York Times, Nov. 28, 2012

I sent them a letter, and my foolish heart thought it had a chance of publication.

I include it here because it summarizes my position briefly.

Hi, NYTimes. Here's a short letter to the editor.

______________________________________________________

Out-of-balance income distribution:

The highest-earning 4.3% of taxpayers, all with incomes above $200,000 per year, take in 28.4% of all personal income, the lower-earning 66.9% take in 31.2% -- I dragged that data down from the Congressional Joint Committee on Taxation report, 2012 -- see

page 28 here http://www.novoco.com/hottopics/resource_files/jcx-18-12.pdf --- So that leaves the remaining 40% of income that goes to taxpayers earning between $75,000 to $200,000. They make up 30% of the U.S. taxpayers.

Again, looking at another source, State of Working America shows the aggregate income of 60% of families in 2010 was 26% of all income, close to the Joint Committee of Taxation's figure of 28.4% for 66.9% of taxpayers, above. Looking a little closer shows that the average income for the top-earning 20% is 3.4 times higher ($50,000 vs. $170,000) than the average for the middle-earning families!

In passing, the U.N. has a measure called the Human Development Index that places the U.S. as #4 among all nations in the world --- but it then downgrades the U.S. to #23 in an index adjusted for inequality -- see these two sources, one and two.

What do the highest-earners, the top 4.3% of tax payers/households, all with incomes over $200,000 each year, do with their wealth? They do not create jobs, as I explain below, private sector employment is exactly the same number it was 12 years ago (111 million private sector employees in spite of a working population increase of 31 million). The income of the 4.3% goes into savings vehicles instead of being spent on human needs. The quality of life diminishes for low-income families who cannot afford food or medical coverage, who often are unemployed, under-employed, mis-matched with employment, or working full-time and full-year for poverty level wages --- in total about 1 in 3 workers, 50 million individuals who support families. Wages are pressed down. An economic slow-down negatively affects those who did nothing or very little to bring it about. Professor Andrew Sum sums up the past decade, 2000 to 2010: "The performance of the U.S. economy in producing additional real output (GDP), new payroll employment opportunities, or any employment for workers (16+) over the past decade was the worst in the past 70 years."

Out-of-balance wealth distribution:

And if you look at household wealth in the U.S., the lowest-saving 50% (59 million households) own just 1.1% of U.S. household net worth, which averages to about $11,000 per family, while the average for the entire nation (118 million households) is $498,000 per family or household. Less than 12% of households own the average or more than $498,000 in net worth. This is inequality writ large. See this Congressional Research Service report, page 4. The average wealth for the top 1% is around 2000 times more than the average for each household in the lower-saving 50% -- but you are free not to believe that because I am not going to show you the calculation.

The Reflation:

Reflating the economy means allowing the federal government to create jobs to increase the employment rate.

Just $200 billion a year expense would re-employ 5 million workers at $40,000 per job per year, and would prompt the hiring of another 2 million in the private sector. It would lower the employment rate to below 5%, maybe even 4% given the additional private sector employment. A $200 billion surtax on the wealthiest 0.8% of households would pay for these government jobs.

My proposal, simply stated, is to reduce the income of the highest-earning 0.8% of tax payers from an average pre-tax income of $1,500,000 a year to a post-tax level of $885,000. The benefit would be a sub-5% unemployment rate and a self-sustaining economic expansion. Wage income and corporate profit income are in constant ascending and descending flux relative to each other. I propose to right the imbalance of the past 30 years.

Collectively the top 0.8% of households have a pre-tax income of $1.7 trillion, 10.7% of all personal income, and a post-tax income of $1.2 trillion, today, which I would decrease to a collective income of $1.003 trillion. So this surtax would reduce their average (not collective) $1.5 million pre-tax income down to $885,000.

Citizens for Tax Justice reports that the top 1% of taxpayers pay 29.0% of all their income to federal, state and local government agencies. I'm suggesting raising their "overall and effective" rate to 41%, that would include their current 29.0% rate and my suggested 12% surtax rate. During the period 1950 to 1963 the effective overall tax rate for the top earning bracket was about 55%, indicating that Dwight D. Eisenhower was more radical in practice than my proposal. The top income tax brackets were nominally at 90% for 20 years (1940s and 1950s), and then at 70% for another 20 years, before President Reagan in 1983 lowered them to the low rate they presently are at, around 35%. The New York Times has an article about tax rates per income group here.

A proposal to raise the effective income tax rate from 22.5% to 45% to the top-earning 1%, offered by an eminent U.C. Berkeley professor, can be read here. This professor would double the tax burden for this minority, increasing their tax bill by $405 billion a year. Read my comment at the bottom of the article, which concludes, "When 1 in 6 workers are still looking for full-time year-round work, allowing that talent to waste away unproductively is irresponsible."

Also, private sector employment has not increased since 2000, 12 years ago, when there were 111 million people working for private sector employers (see BLS data). There are still only 111 million employed in the private sector. If lowering taxes did in fact (and it doesn't) increase private sector employment, then since 2001 with the first Bush-era cuts there would be at least 20 million more private sector jobs today, as 31 million people have increased the "working age" population (a 14.6% increase). The Bush-era Republican tax cuts killed employment growth in its tracks. The years between 2000 and 2010 were the worst on historical record, according to professor Andrew Sum whom I quote (and reference above) in a subsequent essay, and as the Pew Research Center shows in a graph below.

To the producers of the video by Econ4 at http://econ4.org/films -- "Thanks for the good job."

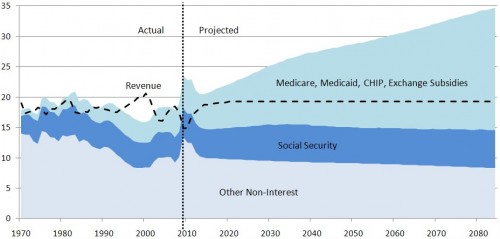

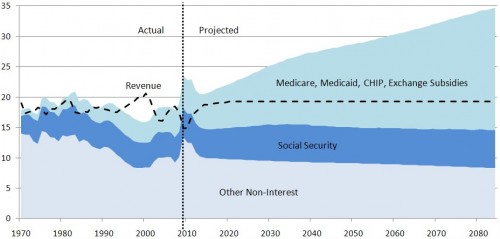

A $200 billion/year surtax may sound excessive, and a U.C. Berkeley professor proposing a $405 billion increase on the top 1% may seem absurd, but the Chicago Political Economy Group has a $900 billion per year spending plan, as does the Economic Policy Institute. Their recent argument to allow the Fiscal Cliff to happen is well worth reading. We have an Employment Gulch, not a Cliff of fiscal malfeasance. James Kwak's recent article also explains this in detail. The entire explanation to the "Cliff" can be found in one simple graph found here, that shows the effect of run-away medical system costs and how it impacts Medicare and the federal budget over the next 60 years. The future federal budget deficit cause is clearly an escalation of medical care costs. The graph is a CBO product, but I found it at a medical-economist site with an interesting article attached.

And lastly, the Economic Policy Institute's Briefing Paper "Putting America Back to Work" outlines a menu of proposals, about 13 of them, that would cost $957 billion -- almost exactly the yearly shortfall in economic performance vs. potential -- and would employ 11,143,000. Now this plan, very professional and worth consideration, puts the adjective "puny" to my simple $200 billion proposal. See last paragraph of this essay for a list of the proposals and their $957 billion cost (or link to the report and read it yourself).

New note: November 20, 2012: Obama is now calling for $1.6 trillion in new revenue (over 10 years), not his previous proposal for $800 billion. See the brief article. Unclear is how he would use the revenue, very unlikely it would all go into more jobs directly. His American Jobs Act proposal of September 2011 posited a $447 billion stimulus, but it included perhaps only $95 billion in actual new employment, exclusive or re-hires at the state and local level. Check his original proposal at these sites, here, and here and http://en.wikipedia.org/wiki/American_Jobs_Act. "In total the legislation includes $253 billion in tax credits (56.6%) and $194 billion in spending and extension of unemployment benefits (43.4%).", states Wikipedia. As I calculate it, only $95 billion in jobs, and that spread over 2 years.

Big Ideas for Job Creation, (view the report) lays out 13 methods for government sponsored job creation. Sponsored by the Annie Casey Foundation and the University of California Berkeley's Institute for Research on Labor and Employment, the report covers Hiring Credits, Subsidized Employment, Short-Term Compensation, Infrastructure Development Partnerships, Direct Job Creation, Retrofitting Institutions, Turning Waste into Jobs, Retrofitting Homes, Reviving Manufacturing, Improving Early Childhood Education, Community-Based Jobs Creation, Minority Owned Businesses, Tax Relief for Entrepreneurs. There are other strategies and reports developed besides the ones mentioned here.

Back to Full Employment

The new web-blog Back to Full Employment explores the issue; it's sponsored by the author of the book with that title, Robert Pollin. Here is a sample essay from two of its contributors who referenced the Big Ideas for Job Creation report. Here is a video with Pollin explaining his book to Laura Flanders at GritTV. Franklin Roosevelt wanted to make the right to employment a civil right. There is a compelling moral argument that a responsible society does not cast aside its willing workers when private employers refuse to hire for compelling economic reasons.

To readers here: my next essays are far more detailed and explain the slow-down with an extensive economic logic. But take a minute to watch the video mentioned at the top. It's worth your while.

InTouch Credit Union Plano Balloon Festival: inflating the balloons.

My normal bad habit is to add onto a post. And here I go again. I just commented to an article by Les Leopold at Alternet. Here's the relevant comment:

The average wage income including benefit compensation for 75% of the U.S. workforce (112.5 million workers) was $24,524 per year, in 2010. The average income for the top-earning 4.3% of taxpayers (6.7 million taxpayers) was $484,000 in 2012 -- a 20 times difference. The combined income of 7 million was greater than that of 113 million.

Wage income is too low, extra high compensation for the very very wealthy is too high. The economy is running below potential when distribution of rewards is so out of balance. It affects everyone. Thanks Les Leopold. My blog -- http://benL8.blogspot.com. I recommend TooMuchonline.org for more details on this imbalance.

And as I mentioned above, here is the breakdown in proposals and costs of the plan "Putting America Back to Work" from the Economic Policy Institute:

EPI --- Putting America Back to Work

Ellison 3.6 million jobs/year $175 bn per year

Energy Improvement

2 million jobs/year $200 bn per year

Medicaid Reimbursement

440,000 jobs/year $88 bn per year

Surface Transportation 175,000 jobs/year $100 bn per year

Payroll tax cut or targeted tax rebate $125 bn per year

Job Creation Tax Credits

1.2 m jobs/year $90 bn per year

Work Sharing 1.0 m jobs/year $4.5 bn per year

TOTAL -- 11,143,000 jobs/year -- $957 billion/year

What is reflation of demand? Who believes in it? As old as J.M. Keynes, it means some sector of the commonwealth -- either business, consumer, or government -- has to re-fire purchasing demand to increase employment to its former level of sufficient employment. This is the strategy Keynes urged upon Roosevelt in an open letter published in the New York Times in January of 1933 before Roosevelt was sworn in. (View letter and note section 5.) Between 1933 and 1937 the unemployment rate dropped from 25% to 9.6% according to this article by Marshall Auerback.

I viewed the recent video at TRNN.com. (Or at original site, http://econ4.org/films) Take a minute to view it. The scholars mostly from University of Massachusetts, Amherst, describe the essential remedy to our sagging economy. I added the following comment:

"We need to reflate demand," states one economist, summarizing the problem.

Consumer purchasing power took a strong hit with the Recession. 15 million people were permanently displaced from work, 11% of the work force, or 1 out of every 9 workers. Only half were re-employed. The BLS states: ". . . U.S. employment had declined by 8.8 million from its prerecession peak." By November 2012, 34 months since its trough or maximum drop, employment has added 4.6 million jobs, which is only about 500,000 ahead of normal labor participation and population growth. At this rate of job growth I calculate that in 33.4 years, around May 1, 2044, the economy will recover its pre-recession employment to population ratio. The net worth of the median household fell by almost 40%, from $126,000 to $77,800 as housing value sunk. Consumer purchases comprise about 80% of economic activity.

An Economy Operating Well Below Potential

An economic depression is a self-inflicted waste of human resources resulting in high unemployment; perhaps $3 trillion of output has been unrealized because of missing purchasing power. State of Working America presents some graphs showing this loss of potential output, $775 billion per year. A more recent essay from EPI states, "U.S. economic output is currently depressed $973 billion below potential economic output --". The shortfall in output is 5.8% below full potential, and for 4 full years the economy has been below 5% of full output. And finally, Dean Baker states, "And of course the United States is also losing close to $1 trillion in output each year, with close to 23 million unemployed, underemployed or out of the workforce altogether because of poor job prospects."

I put the unemployed and under-employed rate at 18.7% or 29 million, and the National Jobs for All Coalition puts it at 16.7% or 27.0 million for November, 2012. and the BLS places it at 14.4% or 22 million. I make a far higher estimate of the "discouraged" and "marginally attached" workers. The National Jobs for All Coalition, a full employment advocacy group, makes good argument for its number, if you are interested.

Inequality of Income

Since 1979 the lower-earning 80% of households (94 million of 118 million households) has lost 10% of its income share, almost all of which went to the top-earning 1% (check the CBO report, page xiii and note the graph on the front cover). The top 1% of households increased its portion from 8% to 17%, post government transfers and taxes. If we had the same distribution as 1979 there would be no depression/recession, each of the 94 million households of the lower-earning 80% would have $11,000 more income each year.

That would only return us to the income distribution levels of 1979.

Presently, the combined total personal incomes of 4.3% of the 155.9 million taxpayers (all with incomes over $200,000 per year) in 2012 was $3.258 trillion. This amount is greater than the combined wage incomes of the lower-earning 86% (129 million workers) of the 150 million wage and salary earners of 2010, or $3.185 trillion. An easier way to remember this is to say: 1 out of 25 taxpayers (4%) has a greater total income than the combined wage incomes of 22 out of 25 wage earners (86%). Or all the wage income of workers earning less than $70,000 a year is less than the combined total income of the top 4% of taxpayers.

An Uncomfortable Fact ---

The Economy Grows 6 Times Faster than Workers' Income ---

Workers' Income Tank during the past 21 years

The U.S. median wage income, inflation adjusted, for all workers has grown by 5.6% between 1990 and 2011, while the inflation adjusted (real) per capita GDP, economic output of the economy, has grown by 33%. Adjusted for inflation the median income for all workers in 1990 was $25,537 and in 2011 it was $26,965. In other words, a given worker is creating 33% more value over a 21 year period but receiving only 6% more income. The "Real GDP/capita" grew from $36,000 to $48,000 in that period. See Social Security Administration reports on Wage Income over the years 1990 to 2011 and tally the median income growth and adjust for inflation, and view the St. Louis Federal Reserve graph on "Real GDP/capita" growth. The mean average wage income growth from 1990 to 2011 (not the median wage income growth -- 5.6% growth -- that I mention above) has increased by 16.5%, about half as fast as overall real per capita GDP growth. So, one may ask, if the overall economy is growing by 33% per human, how is it possible that average wages grow only by 16.5%? One should look to other sources of income, dividends, capital income of all types. See my blog essay of May, 2012, which I admit is as clear as mud, but the broad outlines are there.

The system is broken. I suspect most readers will, and should, balk at the above claim. I suggest you do the long addition problem at the Social Security Administration page on wage income, and compare it with taxpayers' market income at the Joint Committee of Taxation figure (see page 28). I did not fudge the numbers. Also check the Table 2.4 - Income - at State of Working America, to see, that among 117 million households in 2007 the wage income of the lower-earning 80% equals 27.3% of all income, while the total income of the top 6% equals 31.9% of all income. I find this complicated and perhaps too demanding for "blog" information, and also I am comparing households' incomes with taxpayers' market income and workers' wage incomes -- three disparate groups, though not at all mutually exclusive. The trend and broad outlines are all the same very clear.

A recent book explores Wage Policy, Income Distribution and Democratic Theory, by Oren Levin-Waldman (Routledge, 2011). The review states, a wage policy "can accelerate aggregate demand, boost employment, and spur economic development. But such a policy also has another, equally vital consequence: it can reduce income inequality in a way that enhances personal autonomy, gives meaning to the notion of personal responsibility, and fortifies democracy by strengthening opportunities for political and civic participation." In all, wage policy is central to core values drawn from the Age of Enlightenment reflected in the U.S. Declaration of Independence. When Abraham Lincoln was a young man he earned income rowing a small boat transporting travelers to a waiting steam-driven river boat. When his first customers tossed some coins into his skiff he said a whole new world opened up to him, as he had been used to trading strictly by barter. Income is liberating and empowering. Lack of income is the opposite.

40% of Workers Earn 2% of Total Income

The most recent Social Security Administration report appeared last month, November 2012, and it shows 40% of all US workers earned in wages less than $20,000 in 2011, according to the annual Social Security Administration report Wage Statistics for 2011. See the report. Collectively the lower earning 40% of workers earn $198 billion which is 3.2% of all U.S. wage income which is also only 1.7% of all U.S. personal income, about. (Total income figure, $11.468 trillion, comes from the Joint Committee on Taxation, page 28, linked to above) That's 61 million workers out of a total of 150 million earning less than 2% of all income. I did not forget the exclamation point.

To contradict the last paragraph, I looked up the total wage income for the lower-earning 40% of households, at the EPI's State of Working America (see the table). It shows their combined income amounts to 13.0% of all wage income, or 7% of total personal income, not my claim of 1.7%. Household vs. Wage Earners -- many jointly filed income tax reports boost the percentage for the lower-earning 40%, both households and workers. Confusion aside, 1.7% or 7% -- it's a broken system.

I show more details and references later in this essay. But suffice it to say, the labor-rewards market is broken and socially pernicious (has a harmful effect), and we need higher taxation on the top-earning households, and a policy of increasing incomes at the lower-earning levels (see my essays of January 2011 and February 2011). The recent August 2012 publication of the book Take Back the Center by Peter Wenz makes this case, and you can read a little about it here and here.

The Quicksand Economy

To reflate purchasing demand involves rebalancing the distribution of income and wealth. In the lengthy next essay here, at this blog, I quote a NYTimes columnist who shows that wage and salary income are at the lowest portion of total income since 1929, total compensation is down to levels not seen since 1954, and corporate profits as a percentage of GDP are at their highest levels ever. (See this December 2012 article stating the same.) This means typical workers cannot purchase the value of what they are making, therefore they are laid-off and join the unemployed, and the death spiral continues. The employment to population ratio dropped during 2008/2009 and has stagnated at the 1980s level for over 4 years, meaning that if we had the employment rate of 2000 applied to today, we would have not 143 million but 157 million daily workers (10% more than today) and the labor force would be 163 million, not 155 million, and the unemployment rate would be 4.3%. The U3 unemployment rate is not decreasing -- rather, more people are dropping out of looking for work, and labor market growth is just slightly faster than population growth. At the rate of employment growth (22,000 jobs created per month in excess of population growth) of the last 2 years, 2011 and 2012, it will take 33.4 years, or 401 months, not until May of 2044, to regain the employment to population ratio we had in 2007, and longer to achieve the employment to population ratio of 2000. This is not the place to demonstrate my calculations, but the employment growth for the past 2 years has been only 22,000 per month greater than historical workforce participation growth. The alternative to reflating is to wait years, perhaps decades, before debt levels and savings levels allow purchasers to reflate economic activity and employment levels. I explain this (with excruciating detail) in my next blog entry, just below.

_______________________________________________________________________

My Letter to the New York Times, Nov. 28, 2012

I sent them a letter, and my foolish heart thought it had a chance of publication.

I include it here because it summarizes my position briefly.

Hi, NYTimes. Here's a short letter to the editor.

I write a blog, I call it Economics Without Greed. Here's the simple plan:

Increase the effective overall tax rate on the highest earning 0.8% of taxpayers to create 5 million new government jobs. The highest earning 1,156,000 earners, the 0.8% at the top, have a collective income of $1.7 trillion in 2012, according to the Congressional Joint Committee on Taxation (see the source, page 28: http://www.novoco.com/hottopics/resource_files/jcx-18-12.pdf). The average income per tax payer for this top group is $1.5 million a year. I suggest reducing their collective income by $200 billion and applying that to direct government job creation, employing 5 million at an average annual cost of $40,000 per year per employee. This would create additional private sector employment of another 2 million, in total a 7 million gain in employment. The current nearly 8% unemployment rate indicates 12.4 million are officially unemployed, so a 7 million drop would theoretically reduce it to below 4%. But in actual fact about 20 million are unemployed. Nonetheless, the economic goal is a self-sustaining expansion, and this would turn the tide toward that expansion. Once the expansion was in place, the tax rates could be adjusted downwards again.

Two things: the effective overall tax rate for these high earners is 29.0% according to the Citizens for Tax Justice, an organization that releases a yearly report on the "effective overall" tax rates of all Americans. (See their latest report: http://www.ctj.org/pdf/taxday2012.pdf) My proposal would increase this rate for the highest earning 0.8% from 29% to 41%. It would reduce their average pre-tax incomes from $1,500,000 to a post-tax $885,000 per year.

I have more details at my blog, http://benL8.blogspot.com. Check it out. Between 1933 and 1937 the unemployment rate dropped from 25% to 9.6% using this method of economic adjustment.

Thank you, B.L

______________________________________________________

Out-of-balance income distribution:

The highest-earning 4.3% of taxpayers, all with incomes above $200,000 per year, take in 28.4% of all personal income, the lower-earning 66.9% take in 31.2% -- I dragged that data down from the Congressional Joint Committee on Taxation report, 2012 -- see

page 28 here http://www.novoco.com/hottopics/resource_files/jcx-18-12.pdf --- So that leaves the remaining 40% of income that goes to taxpayers earning between $75,000 to $200,000. They make up 30% of the U.S. taxpayers.

Again, looking at another source, State of Working America shows the aggregate income of 60% of families in 2010 was 26% of all income, close to the Joint Committee of Taxation's figure of 28.4% for 66.9% of taxpayers, above. Looking a little closer shows that the average income for the top-earning 20% is 3.4 times higher ($50,000 vs. $170,000) than the average for the middle-earning families!

In passing, the U.N. has a measure called the Human Development Index that places the U.S. as #4 among all nations in the world --- but it then downgrades the U.S. to #23 in an index adjusted for inequality -- see these two sources, one and two.

What do the highest-earners, the top 4.3% of tax payers/households, all with incomes over $200,000 each year, do with their wealth? They do not create jobs, as I explain below, private sector employment is exactly the same number it was 12 years ago (111 million private sector employees in spite of a working population increase of 31 million). The income of the 4.3% goes into savings vehicles instead of being spent on human needs. The quality of life diminishes for low-income families who cannot afford food or medical coverage, who often are unemployed, under-employed, mis-matched with employment, or working full-time and full-year for poverty level wages --- in total about 1 in 3 workers, 50 million individuals who support families. Wages are pressed down. An economic slow-down negatively affects those who did nothing or very little to bring it about. Professor Andrew Sum sums up the past decade, 2000 to 2010: "The performance of the U.S. economy in producing additional real output (GDP), new payroll employment opportunities, or any employment for workers (16+) over the past decade was the worst in the past 70 years."

Out-of-balance wealth distribution:

And if you look at household wealth in the U.S., the lowest-saving 50% (59 million households) own just 1.1% of U.S. household net worth, which averages to about $11,000 per family, while the average for the entire nation (118 million households) is $498,000 per family or household. Less than 12% of households own the average or more than $498,000 in net worth. This is inequality writ large. See this Congressional Research Service report, page 4. The average wealth for the top 1% is around 2000 times more than the average for each household in the lower-saving 50% -- but you are free not to believe that because I am not going to show you the calculation.

The Reflation:

Reflating the economy means allowing the federal government to create jobs to increase the employment rate.

Just $200 billion a year expense would re-employ 5 million workers at $40,000 per job per year, and would prompt the hiring of another 2 million in the private sector. It would lower the employment rate to below 5%, maybe even 4% given the additional private sector employment. A $200 billion surtax on the wealthiest 0.8% of households would pay for these government jobs.

My proposal, simply stated, is to reduce the income of the highest-earning 0.8% of tax payers from an average pre-tax income of $1,500,000 a year to a post-tax level of $885,000. The benefit would be a sub-5% unemployment rate and a self-sustaining economic expansion. Wage income and corporate profit income are in constant ascending and descending flux relative to each other. I propose to right the imbalance of the past 30 years.

Collectively the top 0.8% of households have a pre-tax income of $1.7 trillion, 10.7% of all personal income, and a post-tax income of $1.2 trillion, today, which I would decrease to a collective income of $1.003 trillion. So this surtax would reduce their average (not collective) $1.5 million pre-tax income down to $885,000.

Citizens for Tax Justice reports that the top 1% of taxpayers pay 29.0% of all their income to federal, state and local government agencies. I'm suggesting raising their "overall and effective" rate to 41%, that would include their current 29.0% rate and my suggested 12% surtax rate. During the period 1950 to 1963 the effective overall tax rate for the top earning bracket was about 55%, indicating that Dwight D. Eisenhower was more radical in practice than my proposal. The top income tax brackets were nominally at 90% for 20 years (1940s and 1950s), and then at 70% for another 20 years, before President Reagan in 1983 lowered them to the low rate they presently are at, around 35%. The New York Times has an article about tax rates per income group here.

A proposal to raise the effective income tax rate from 22.5% to 45% to the top-earning 1%, offered by an eminent U.C. Berkeley professor, can be read here. This professor would double the tax burden for this minority, increasing their tax bill by $405 billion a year. Read my comment at the bottom of the article, which concludes, "When 1 in 6 workers are still looking for full-time year-round work, allowing that talent to waste away unproductively is irresponsible."

Also, private sector employment has not increased since 2000, 12 years ago, when there were 111 million people working for private sector employers (see BLS data). There are still only 111 million employed in the private sector. If lowering taxes did in fact (and it doesn't) increase private sector employment, then since 2001 with the first Bush-era cuts there would be at least 20 million more private sector jobs today, as 31 million people have increased the "working age" population (a 14.6% increase). The Bush-era Republican tax cuts killed employment growth in its tracks. The years between 2000 and 2010 were the worst on historical record, according to professor Andrew Sum whom I quote (and reference above) in a subsequent essay, and as the Pew Research Center shows in a graph below.

To the producers of the video by Econ4 at http://econ4.org/films -- "Thanks for the good job."

A $200 billion/year surtax may sound excessive, and a U.C. Berkeley professor proposing a $405 billion increase on the top 1% may seem absurd, but the Chicago Political Economy Group has a $900 billion per year spending plan, as does the Economic Policy Institute. Their recent argument to allow the Fiscal Cliff to happen is well worth reading. We have an Employment Gulch, not a Cliff of fiscal malfeasance. James Kwak's recent article also explains this in detail. The entire explanation to the "Cliff" can be found in one simple graph found here, that shows the effect of run-away medical system costs and how it impacts Medicare and the federal budget over the next 60 years. The future federal budget deficit cause is clearly an escalation of medical care costs. The graph is a CBO product, but I found it at a medical-economist site with an interesting article attached.

And lastly, the Economic Policy Institute's Briefing Paper "Putting America Back to Work" outlines a menu of proposals, about 13 of them, that would cost $957 billion -- almost exactly the yearly shortfall in economic performance vs. potential -- and would employ 11,143,000. Now this plan, very professional and worth consideration, puts the adjective "puny" to my simple $200 billion proposal. See last paragraph of this essay for a list of the proposals and their $957 billion cost (or link to the report and read it yourself).

New note: November 20, 2012: Obama is now calling for $1.6 trillion in new revenue (over 10 years), not his previous proposal for $800 billion. See the brief article. Unclear is how he would use the revenue, very unlikely it would all go into more jobs directly. His American Jobs Act proposal of September 2011 posited a $447 billion stimulus, but it included perhaps only $95 billion in actual new employment, exclusive or re-hires at the state and local level. Check his original proposal at these sites, here, and here and http://en.wikipedia.org/wiki/American_Jobs_Act. "In total the legislation includes $253 billion in tax credits (56.6%) and $194 billion in spending and extension of unemployment benefits (43.4%).", states Wikipedia. As I calculate it, only $95 billion in jobs, and that spread over 2 years.

Big Ideas for Job Creation, (view the report) lays out 13 methods for government sponsored job creation. Sponsored by the Annie Casey Foundation and the University of California Berkeley's Institute for Research on Labor and Employment, the report covers Hiring Credits, Subsidized Employment, Short-Term Compensation, Infrastructure Development Partnerships, Direct Job Creation, Retrofitting Institutions, Turning Waste into Jobs, Retrofitting Homes, Reviving Manufacturing, Improving Early Childhood Education, Community-Based Jobs Creation, Minority Owned Businesses, Tax Relief for Entrepreneurs. There are other strategies and reports developed besides the ones mentioned here.

Back to Full Employment

The new web-blog Back to Full Employment explores the issue; it's sponsored by the author of the book with that title, Robert Pollin. Here is a sample essay from two of its contributors who referenced the Big Ideas for Job Creation report. Here is a video with Pollin explaining his book to Laura Flanders at GritTV. Franklin Roosevelt wanted to make the right to employment a civil right. There is a compelling moral argument that a responsible society does not cast aside its willing workers when private employers refuse to hire for compelling economic reasons.

To readers here: my next essays are far more detailed and explain the slow-down with an extensive economic logic. But take a minute to watch the video mentioned at the top. It's worth your while.

InTouch Credit Union Plano Balloon Festival: inflating the balloons.

My normal bad habit is to add onto a post. And here I go again. I just commented to an article by Les Leopold at Alternet. Here's the relevant comment:

28.3% of all income goes to the top-earning 4.3% of taxpayers, and that averages to almost $500,000 per earner for 6.6 million earners, according to the Joint Committee on Taxation 2012 report. All 6.6 million have incomes over $200,000. (See page 28 of --http://www.novoco.com/hottopics/resource_files/jcx-18-12.pdf)

In contrast the wage income of the lowest-earning 75% (112.5 million workers) all with wage income under $50,000 is 19% of total personal income, drawing on Social Security Administration's report on wage income (see --http://www.ssa.gov/cgi-bin/netcomp.cgi?year=2010). Add on some benefit compensation to the earnings of the lower-earning 75% (it would increase total compensation to 24% of total national personal income), and you are still less than the income (24% vs. 28.3%) of the top 4.3%.

To cross-check this analysis, go to State of Working America, Income chart. This shows that 27% of all income goes to the lower-earning 80% of households as wage income. (50.1% of all wage income multiplied to 54.3% of all income = 27%)

Les Leopold's article:

http://www.alternet.org/comments/economy/8-reasons-wall-street-greed-cause-and-solution-phony-fiscal-cliff-crisis#disqus_thread

EPI --- Putting America Back to Work

Schakowsky 2.2 million jobs/year $114 bn per year

Ellison 3.6 million jobs/year $175 bn per year

Energy Improvement

2 million jobs/year $200 bn per year

Medicaid Reimbursement

440,000 jobs/year $88 bn per year

Surface Transportation 175,000 jobs/year $100 bn per year

Payroll tax cut or targeted tax rebate $125 bn per year

Emergency Unemployment Compensation

528,000 jobs/year $60 bn per year

Job Creation Tax Credits

1.2 m jobs/year $90 bn per year

Work Sharing 1.0 m jobs/year $4.5 bn per year

TOTAL -- 11,143,000 jobs/year -- $957 billion/year