The Rising Tide That Did Not Lift All Boats

What if a rising tide lifts 5 percent of the boats? What happens to the other 95 percent of boats?

They either sink or are water-logged. The U.S. economy grew over the past 30 years but only the top-income 5 percent kept up with the overall growth rate of the economy. The rising tide left others below. Prosperity was not shared evenly, only marginally. This uneven sharing caused massive employment losses as I show. I have essays with many solutions to this problem, see this one and this one.

This essay tries to show how preventable inequality erodes economic growth, saps human potential, and lessens life pleasure for all.

Details of Inequality ---

U.S. households own on average $498,000 per household, yet half own less than $77,300. (See this source, pages 3 and 4.) The average net worth of half (50%) of America's households is less than $11,000 while the average for all (100%) is $498,000. Is that enough inequality to make one think?

The average family income in 2010 was $78,500, but the median was $45,800 according to the Federal Reserve's Survey of Consumer Finances, 2012, (page 17 and 8 respectively for wealth and income stats). To confirm, State of Working America shows the average income for all families at $69,661 for 2010, with an average of $50,865. The median income is much below the average in both cases indicating a large skew towards inequality at the top. In this last, the average for the top one fifth of households is 3.5 times higher than the average for the middle income families.

The average worker contributes $109,000 to the GDP or economic output, but half of all workers earned less than $26,363 in 2010, and collectively the wage income for all in the lower-earning 50% (75 million workers out of a total of 150 million) averages below $11,000 per worker. (See this source and this source.)

Our economy generates over $47,000 per human, over $109,000 per worker, and over $140,000 per household. Why do 16.1% face food insecurity in 2011 and 15.0% live in poverty?

The Pew Research Center provides this 60 year summation of economic growth: 20 years of shared growth, 10 years of very weak but shared growth, and 20 years of one-sided non-shared growth, and 10 years of decline and reversal. Capitalism works well only when there is a wide-spread distribution of purchasing power, or else it collapses, literally. This is the forgotten lesson of the Great Depression. Jeff Madrick's book Why Economies Grow explains a fundamental premise of Keynesian economics, "Large markets make economies of scale possible and thus encourage saving, investment, and the development of new products."

Wage growth has been very one-sided since 1973 as this chart from the Economic Policy Center shows. (you must click to see)

Capitalism is a step beyond feudalism because money is widely distributed and large markets are developed, even if income and wealth are still highly concentrated at the very top. Socialism is a step beyond capitalism in that surplus and prosperity are consciously and democratically shared. At this stage in the U.S. economy's "recovery" only the top 5% of households at the top income level have "recovered" their pre-Recession income level. Today 80% of the work force (124 million workers) are non-supervisory workers, also known as employees. The lower-earning 80% earn in wages just 29% of all household income, their wages are under constant downward pressure; as a percentage of all income wage income is at an all-time low of 49.6% of GDP (details below), while corporate profits are at an all-time high, over 14% of total national income (see NYTimes article). In the past 12 years the number of private sector workers has not grown, period, in spite of the working age population having grown by 14.6% or 31 million adults. (details below). As the economy's rewards are more and more concentrated, demand slackens, investment slackens, employment slackens, and growth stalls for as far as the eye can see.

Sources: An interview with Heiner Flassbeck at the Real News Network explains much of this. Flassbeck is a director at the United Nations Conference on Trade and Development (UNCTAD) and author of their Trade and Development Report, 2012. "Low Wages and High Unemployment Are Paralyzing the Global Economy" is the title of the interview. The academic economists' side of the picture can be found at "Ten Theses on New Developmentalism", an international group who assert that development only proceeds under correct structural architecture in which the state plays a central role.

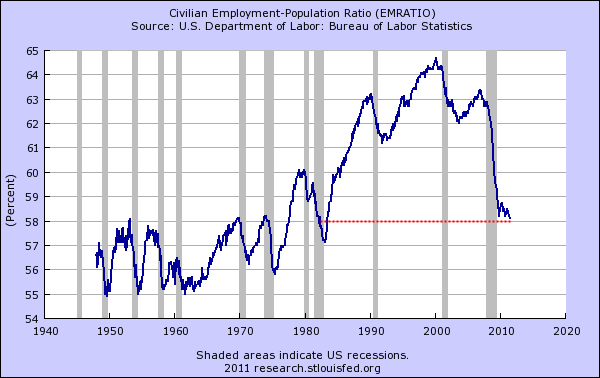

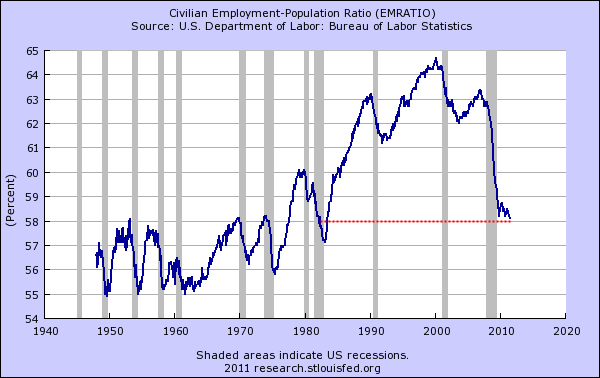

A fatal flaw plagues an economy that does not share its prosperity. Inevitably it must lay-off millions of private sector workers, and this in turn shrinks its ratio of employment to population. Since July 2000, 12 years ago, U.S. private enterprise has added only 8 thousand private sector workers in spite of having grown the working age population by 31 million, from 212 million in 2000 to 243 million in June 2012. We have 14.6% more working age citizens, same number of private sector jobs. In July 2000 there were 111,137,000 private sector workers, and in June 2012 there were 111,145,000 workers --- 8,000 more. Essentially flat in spite of a growth of 31 million working age population! See this bls source. And create your own graph, at "data bls, private sector employment". Or, below, the graph from the St. Louis Federal Reserve:

(To make this graph, google "data bls, employment to population ratio".) The previous low point is 1984, then 1978. Even in March 1953 the ratio was 58.1%, close to what it is today, July 2012, at 58.4%. For 20 years it had been above 62%, with a few exceptions. The fall-off from January 2000, at 64.4%, to today's 58.4% represents in today's labor market a drop of 6.0% of the "working age population", or 14.6 million workers, 9.5% of the labor force, who had employment in 2000 but are out of luck today. The true U3 unemployment rate is above 13% if one assumes the labor participation rate of 2000. Andrew Sum's article summarizes the labor distress better than any I've read. Reporting on the 2000 to 2010 period, he provides a snapshot of the end of the decade, 2010: "The 15 million official unemployed were accompanied by 9 million underemployed [part-time wanting full-time], 6 million hidden unemployed (wanting work but no longer actively looking), and 10 million malemployed college graduates working in jobs that do not require a college degree. Over 40 million American adults were facing one of these four labor market problems in 2010, the largest number by far in the past 50 years." What portion is 40 million? 26% of the labor force.

But let's be complete, let's add on full-time-year-round workers who receive below poverty level wages; 16.8 million workers (see this source drawing on U.S. Census data). So we have about 57 million workers in five separate and distinct categories (except for the college graduates who may fall into two of the categories) -- well over 1 of every 3 in the work force of 154 million workers. This is a classic waste of human resources. I can think of ways to poke holes into this argument, but the conclusion is not affected. How to remedy this waste of resources?

Why? When workers cannot purchase what they produce the minority business owners must lay off a portion. Private enterprise only produces what it can sell. Declining wage share relative to total product value leads to decreasing employment to population ratio. You'll read below that wage income has dropped to 49.6% of total income, an all-time low.

The following graph from State of Working America I term

The Weight of Greed on Human Progress.

(You must click to see entire graph at its source.)

In 1979 the economy produced $100 per citizen, and in 2007, 28 years later, it produced $168 per citizen, a healthy 68% gain. In 1963 John F. Kennedy coined the phrase, "A rising tide lifts all boats." But between 1979-2007, the tide failed. Only 5% of the boats rose at a rate faster than the overall economy's growth rate. The GDP per capita rate between 1979-2007 rose by 68.1%, as calculated at this site.

CBO Report on Income Growth, 1979 to 2007

From the Congressional Budget Office report Trends in the Distribution of Income Between 1979 and 2007, page 37, we can compute the post-tax and post-transfer income change for households over 28 years at seven different income levels:

20th percentile household --- 23% income gain, from $15,411 to $18,979.

40th percentile --- 30%

60th percentile --- 39%

80th percentile --- 47%

90th percentile --- 57%

95th percentile --- 70%

100 percentile --- 118%

Therefore, only about 5% of households kept pace or exceeded the growth rate of the economy, 95% fell below the growth rate.

Only 7% growth (1979 to 2010) for the middle income household occurs when we extend the period from 1979 to 2010, according to this table at State of Working America. The real per capita growth was 62% 1979 to 2007 according to this source.

Why is this important? Workers must be laid off as a result. The private economy only produces what it can sell.

Even though all income sectors grew, most sectors grew below the growth rate of output, GDP, and therefore the lower-earners cannot consume or buy all that they produce. Therefore they get "canned" by their employer. "When their credit runs out the game will stop." --- see the quote just below.

The State of Working America released its newest edition in September, 2012, and here's their graph using data from the CBO report I mention below. It shows the change in income-share between 1979 and 2007. As I say elsewhere, the incomes of all 94.4 million households in the lower-earning 80% of households would receive about $11,000 more income each year if we had the same distribution as in 1979. The recession would be over.

"Change in the share of market income and post-tax, post-transfer income that households claim, by income group, 1979-2007"

When workers' remuneration has not kept pace with the cost of the goods and services they either must borrow or buy less. If they buy less, the minority owner population must lay-off workers as goods and services go unpurchased. This is inescapable. Marriner Eccles, the Chairman of the Federal Reserve 1934-1948, stated in his memoir, "The United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out the game will stop."

When workers' remuneration has not kept pace with the cost of the goods and services they either must borrow or buy less. If they buy less, the minority owner population must lay-off workers as goods and services go unpurchased. This is inescapable. Marriner Eccles, the Chairman of the Federal Reserve 1934-1948, stated in his memoir, "The United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out the game will stop."

The Game Will End?

This sounds like a euphemism for "catastrophe will befall such an economy."

Here's the recent U.S. Census report's data in graphic form showing income growth of each quintile (fifth) and the top 5% from 1964 to 2011. I took this graph from the excellent weekly newsletter Too Much. (September 17, 2012 edition) I recommend all readers subscribe to it. And I note the small print at the bottom says that capital gains are not included. Another table at State of Working America shows that 31.3% of the income of the top-earning 1% is capital gains income, so the top line below should reach perhaps up into the $400,000 level.

Here's just one graph showing how household debt to disposable income increased since 1990. (Click to see entire graph)

These last two originate from the Federal Reserve.

Three Important Quotes from Respected Scholars

According to the President of the Center on Budget and Policy Priorities, Robert Greenstein, March 9, 2011: " Between 1976 and 2007, the U.S. gross domestic product (GDP) grew 66 percent per person, adjusted for inflation. But the average income for the top 1 percent of Americans increased by 280 percent, in inflation-adjusted terms, while the average income of the bottom 90 percent of Americans stagnated, growing just 8 percent over this 30-year period."

Lawrence Mishel at the Economic Policy Institute states, May 3, 2012, "From 1978–2011, CEO compensation grew more than 725 percent, substantially more than the stock market and remarkably more than the annual compensation of a typical private-sector worker, which grew a meager 5.7 percent."

"Top 1 percent incomes grew by 58% from 1993 to 2010 (implying a 2.7% annual growth rate). This implies that top 1 percent incomes captured slightly more than half of the overall economic growth of real incomes per family over the period 1993-2010." (page 3) This 17 year period is demonstrative of the 28 year period the CBO report reports on. The statement comes from University of California professor Emmanuel Saez' report Striking It Richer. Since the official end of the Recession in June 2009 he says, "Hence, the top 1% captured 93% of the income gains in the first year of recovery. Such an uneven recovery can help explain the recent public demonstrations against inequality." (page 4) His graph, Figure 1, shows the increase of income share received by the top 10%, and the top 1%, Figure 2.

The Income Pie -- Portions Change

Returning to the CBO report, the top 1% increased from 8% to 17% --- a 9% shift in share size --- its post-tax and post-transfer income share over the period 1979 to 2007. (page xiii). All the 9% share came at a loss of share size from the lower-earning 80% of households, 94.4 million households. And in today's dollars, 9% of personal income is $1.032 trillion. Divided evenly among the 94.4 million households in the lower 80% who in 1979 received that income share, each household would increase its income by $10,933. The Recession would be over.

Growth of household debt

Christian Weller in an article in Challenge magazine, January 2012, shows in Figure 1 a graph of Household Debt to After-Tax Income, 1952 -2011. Between 1962 and 1985, the debt level ranged between 60% and 65%. Between 1990 and 200 the debt level increased from 80% to 90%. After 2000 to 2007 it exploded from 90% to 130%. Since 2007 it has receded to 114%. From Weller's article:

Between March 2001 to December 2007 "the debt burden increased at an unprecedented rate during the last business cycle, laying the foundation for a lot of economic pain to follow." (See his economic shapshot.)

Middle income households in the 3rd, 4th and 5th quintiles held the greatest debt-to-income ratios. "For households in the third and fourth quintile, earning between $39,100 and $100,000 in 2007, the median debt-to-income ratio was higher than for any other income groups, with 130.7 percent and 155.4 percent." And the highest quintile ratio exceeded 120%, while the two lowest quintiles held ratios at 70% and 60%.

"The implications for the current tepid economic recovery are huge. High household indebtedness is one factor that holds back consumption growth in the recovery and thus impedes faster economic growth and more hiring. . . . But consumption growth amounted to a total of only 4.3 percent for the first eight quarters of this recovery [to mid 2011], which is the slowest growth rate for any recovery of this length since World War II." He mentions that not until 2036 will debt levels return to below 90% given very high rates of income growth and normal growth rates for debt. The household savings rate has sunk to low levels recently, around 3.4%. See this graph at the St. Louis Federal Reserve.

http://research.stlouisfed.org/fred2/series/PSAVERT

Weller proposes remedies for debt relief, but he says "The benefits from faster income growth are larger than from refinancing, since interest rates cannot fall much further from where they are now." He proposes "boosting after-tax incomes through faster job creation by [government] investing in infrastructure." Omitting the word "government" is a mistake. Nouriel Roubini's "The Way Forward", the Progressive Caucus's budget, the Economic Policy Institute's proposal, Philip Harvey's "Back to Work", are all plans for robust government job creation programs that would aid the economy more than refinancing solutions which also are needed.

Finance Conquers the U.S. Economy

William Tabb's book The Restructuring of Capitalism in Our Time states, "In 1980 the total value of world financial assets was $12 trillion, about equal to global GDP, . . . In 2005 it was more than three times global GDP (McKinsey & Company 2006:9)." The U.S. finance sector led the way in expansion. During this time finance expanded 4.5 times faster than the GDP per capita. This was a train wreck in slow motion. "Corporate profits from the financial sector of the U.S. economy in 2004 were . . . 40 percent of all domestic corporate profits that year. They had been less than 2 percent of total domestic corporate profits forty years earlier [in 1964]." (page 14)

Corporate Profits --

"the highest proportion ever recorded"

Floyd Norris reported in the New York Times, August 5, 2011, "Nonetheless, President John F. Kennedy’s observation that a rising tide lifts all boats is no longer as true as it once was.

http://www.nytimes.com/2011/08/06/business/workers-wages-chasing-corporate-profits-off-the-charts.html?_r=1

Floyd Norris states,

"The new figures indicate that corporate profits accounted for 14 percent of the total national income in 2010, the highest proportion ever recorded. . . . The 2010 total [compensation including wages, salaries and benefits], of 62.1 percent, is not close to the record low share of 54.5 percent, set in 1929, the first year for which numbers are available. But it is the lowest for any full year since 1965" Norris continues, "Nonetheless, President John F. Kennedy’s observation that a rising tide lifts all boats is no longer as true as it once was.

This is the picture of non-sharing.

The Economics of Greed.

The State of Working America draws much the same conclusion under their topic of "wages", see the source.

And a graph from Floyd Norris' article from the NYTimes:

TED Video on Economics

Nick Hanuer presented a talk at the TED forum which later was censored from its site. Later it was re-instated at YouTube. The content of the talk mirrors much that I have argued about taxation, job growth, income distribution.

http://www.youtube.com/watch?v=bBx2Y5HhplI

James Carville and Stan Greenberg new book

It's the Middle Class, Stupid" is the title of their new book. Carville's article in the WSJ says,

"The actual solution to our economic situation is straightforward: increased government spending, well in excess of what the 2009 Recovery Act contemplated and what a tea party-dominated Congress would now allow."

Read the Wall Street Journal article here.

Romney and His Plan

My friend's teen-age daughter came home distraught. The teen said her best friend's family had met over the weekend and decided that they were all supporting Romney. What I might say to her daughter? The Center for Budget and Policy Priorities says of Romney's budget cutting plan, "non-defense programs other than Social Security would have to be cut 29 percent in 2016 and 59 percent in 2022 (see Figure 1)." This means all government including Medicare and Medicaid would be 40% of today's size, with the exception of the military and Social Security, if Romney gets his way. Half of Medicaid goes to senior citizens in nursing homes. What a disaster this plan would be. Literally a horror. People would be dying on the sidewalks. In my opinion his plan would destroy government as we know it.

http://www.cbpp.org/cms/index.cfm?fa=view&id=3658

In September, 2011, Obama released a plan to increase private sector hiring. I view it as a tepid plan.

The New York Times has an article. A better resume may be this article at Reuters. Though the expense would be $447 billion, the funds dedicated to creating new jobs is about $100 billion.

Read more: http://swampland.time.com/2012/07/11/the-green-team-jill-steins-third-party-bid-to-shake-up-2012/#ixzz22Wr63kT2

The Green New Deal is a plan full of new rights: the right to employment, at a living wage, quality health care, tuition free education, affordable housing and utilities, and fair taxation. It proposes creating 16 million jobs in energy retrofits and the like, reducing military spending by 50%, restructuring the financial system, and the electoral system, one point is to create a national holiday on election day.

Now Jill Stein's plan I can endorse (she is the Green Party candidate), but I may write in the name of Representative Jan Schakowsky of Illinois for her courageous budget proposal as a member of the "Bowles-Simpson" committee on the deficit.

Justice Party presidential candidate Rocky Anderson. (Photo courtesy of Rocky Anderson)

Justice Party presidential candidate Rocky Anderson. (Photo courtesy of Rocky Anderson)

What if a rising tide lifts 5 percent of the boats? What happens to the other 95 percent of boats?

They either sink or are water-logged. The U.S. economy grew over the past 30 years but only the top-income 5 percent kept up with the overall growth rate of the economy. The rising tide left others below. Prosperity was not shared evenly, only marginally. This uneven sharing caused massive employment losses as I show. I have essays with many solutions to this problem, see this one and this one.

This essay tries to show how preventable inequality erodes economic growth, saps human potential, and lessens life pleasure for all.

Details of Inequality ---

U.S. households own on average $498,000 per household, yet half own less than $77,300. (See this source, pages 3 and 4.) The average net worth of half (50%) of America's households is less than $11,000 while the average for all (100%) is $498,000. Is that enough inequality to make one think?

The average family income in 2010 was $78,500, but the median was $45,800 according to the Federal Reserve's Survey of Consumer Finances, 2012, (page 17 and 8 respectively for wealth and income stats). To confirm, State of Working America shows the average income for all families at $69,661 for 2010, with an average of $50,865. The median income is much below the average in both cases indicating a large skew towards inequality at the top. In this last, the average for the top one fifth of households is 3.5 times higher than the average for the middle income families.

The average worker contributes $109,000 to the GDP or economic output, but half of all workers earned less than $26,363 in 2010, and collectively the wage income for all in the lower-earning 50% (75 million workers out of a total of 150 million) averages below $11,000 per worker. (See this source and this source.)

Our economy generates over $47,000 per human, over $109,000 per worker, and over $140,000 per household. Why do 16.1% face food insecurity in 2011 and 15.0% live in poverty?

The Pew Research Center provides this 60 year summation of economic growth: 20 years of shared growth, 10 years of very weak but shared growth, and 20 years of one-sided non-shared growth, and 10 years of decline and reversal. Capitalism works well only when there is a wide-spread distribution of purchasing power, or else it collapses, literally. This is the forgotten lesson of the Great Depression. Jeff Madrick's book Why Economies Grow explains a fundamental premise of Keynesian economics, "Large markets make economies of scale possible and thus encourage saving, investment, and the development of new products."

Wage growth has been very one-sided since 1973 as this chart from the Economic Policy Center shows. (you must click to see)

Capitalism is a step beyond feudalism because money is widely distributed and large markets are developed, even if income and wealth are still highly concentrated at the very top. Socialism is a step beyond capitalism in that surplus and prosperity are consciously and democratically shared. At this stage in the U.S. economy's "recovery" only the top 5% of households at the top income level have "recovered" their pre-Recession income level. Today 80% of the work force (124 million workers) are non-supervisory workers, also known as employees. The lower-earning 80% earn in wages just 29% of all household income, their wages are under constant downward pressure; as a percentage of all income wage income is at an all-time low of 49.6% of GDP (details below), while corporate profits are at an all-time high, over 14% of total national income (see NYTimes article). In the past 12 years the number of private sector workers has not grown, period, in spite of the working age population having grown by 14.6% or 31 million adults. (details below). As the economy's rewards are more and more concentrated, demand slackens, investment slackens, employment slackens, and growth stalls for as far as the eye can see.

Sources: An interview with Heiner Flassbeck at the Real News Network explains much of this. Flassbeck is a director at the United Nations Conference on Trade and Development (UNCTAD) and author of their Trade and Development Report, 2012. "Low Wages and High Unemployment Are Paralyzing the Global Economy" is the title of the interview. The academic economists' side of the picture can be found at "Ten Theses on New Developmentalism", an international group who assert that development only proceeds under correct structural architecture in which the state plays a central role.

A fatal flaw plagues an economy that does not share its prosperity. Inevitably it must lay-off millions of private sector workers, and this in turn shrinks its ratio of employment to population. Since July 2000, 12 years ago, U.S. private enterprise has added only 8 thousand private sector workers in spite of having grown the working age population by 31 million, from 212 million in 2000 to 243 million in June 2012. We have 14.6% more working age citizens, same number of private sector jobs. In July 2000 there were 111,137,000 private sector workers, and in June 2012 there were 111,145,000 workers --- 8,000 more. Essentially flat in spite of a growth of 31 million working age population! See this bls source. And create your own graph, at "data bls, private sector employment". Or, below, the graph from the St. Louis Federal Reserve:

A roller coaster ride over 12 years, but a net gain of only 300,000 jobs in 12 years between February 2001 and July 2012, while the working age population grew steadily by 31 million, an increase of 14.6%.

The next graph shows the employment to (working) population ratio.

(To make this graph, google "data bls, employment to population ratio".) The previous low point is 1984, then 1978. Even in March 1953 the ratio was 58.1%, close to what it is today, July 2012, at 58.4%. For 20 years it had been above 62%, with a few exceptions. The fall-off from January 2000, at 64.4%, to today's 58.4% represents in today's labor market a drop of 6.0% of the "working age population", or 14.6 million workers, 9.5% of the labor force, who had employment in 2000 but are out of luck today. The true U3 unemployment rate is above 13% if one assumes the labor participation rate of 2000. Andrew Sum's article summarizes the labor distress better than any I've read. Reporting on the 2000 to 2010 period, he provides a snapshot of the end of the decade, 2010: "The 15 million official unemployed were accompanied by 9 million underemployed [part-time wanting full-time], 6 million hidden unemployed (wanting work but no longer actively looking), and 10 million malemployed college graduates working in jobs that do not require a college degree. Over 40 million American adults were facing one of these four labor market problems in 2010, the largest number by far in the past 50 years." What portion is 40 million? 26% of the labor force.

But let's be complete, let's add on full-time-year-round workers who receive below poverty level wages; 16.8 million workers (see this source drawing on U.S. Census data). So we have about 57 million workers in five separate and distinct categories (except for the college graduates who may fall into two of the categories) -- well over 1 of every 3 in the work force of 154 million workers. This is a classic waste of human resources. I can think of ways to poke holes into this argument, but the conclusion is not affected. How to remedy this waste of resources?

Why? When workers cannot purchase what they produce the minority business owners must lay off a portion. Private enterprise only produces what it can sell. Declining wage share relative to total product value leads to decreasing employment to population ratio. You'll read below that wage income has dropped to 49.6% of total income, an all-time low.

The following graph from State of Working America I term

The Weight of Greed on Human Progress.

(You must click to see entire graph at its source.)

In 1979 the economy produced $100 per citizen, and in 2007, 28 years later, it produced $168 per citizen, a healthy 68% gain. In 1963 John F. Kennedy coined the phrase, "A rising tide lifts all boats." But between 1979-2007, the tide failed. Only 5% of the boats rose at a rate faster than the overall economy's growth rate. The GDP per capita rate between 1979-2007 rose by 68.1%, as calculated at this site.

CBO Report on Income Growth, 1979 to 2007

From the Congressional Budget Office report Trends in the Distribution of Income Between 1979 and 2007, page 37, we can compute the post-tax and post-transfer income change for households over 28 years at seven different income levels:

20th percentile household --- 23% income gain, from $15,411 to $18,979.

40th percentile --- 30%

60th percentile --- 39%

80th percentile --- 47%

90th percentile --- 57%

95th percentile --- 70%

100 percentile --- 118%

Therefore, only about 5% of households kept pace or exceeded the growth rate of the economy, 95% fell below the growth rate.

Only 7% growth (1979 to 2010) for the middle income household occurs when we extend the period from 1979 to 2010, according to this table at State of Working America. The real per capita growth was 62% 1979 to 2007 according to this source.

Why is this important? Workers must be laid off as a result. The private economy only produces what it can sell.

Even though all income sectors grew, most sectors grew below the growth rate of output, GDP, and therefore the lower-earners cannot consume or buy all that they produce. Therefore they get "canned" by their employer. "When their credit runs out the game will stop." --- see the quote just below.

The State of Working America released its newest edition in September, 2012, and here's their graph using data from the CBO report I mention below. It shows the change in income-share between 1979 and 2007. As I say elsewhere, the incomes of all 94.4 million households in the lower-earning 80% of households would receive about $11,000 more income each year if we had the same distribution as in 1979. The recession would be over.

"Change in the share of market income and post-tax, post-transfer income that households claim, by income group, 1979-2007"

1979–2007

The Game Will End?

This sounds like a euphemism for "catastrophe will befall such an economy."

Here's the recent U.S. Census report's data in graphic form showing income growth of each quintile (fifth) and the top 5% from 1964 to 2011. I took this graph from the excellent weekly newsletter Too Much. (September 17, 2012 edition) I recommend all readers subscribe to it. And I note the small print at the bottom says that capital gains are not included. Another table at State of Working America shows that 31.3% of the income of the top-earning 1% is capital gains income, so the top line below should reach perhaps up into the $400,000 level.

Here's just one graph showing how household debt to disposable income increased since 1990. (Click to see entire graph)

These last two originate from the Federal Reserve.

Three Important Quotes from Respected Scholars

According to the President of the Center on Budget and Policy Priorities, Robert Greenstein, March 9, 2011: " Between 1976 and 2007, the U.S. gross domestic product (GDP) grew 66 percent per person, adjusted for inflation. But the average income for the top 1 percent of Americans increased by 280 percent, in inflation-adjusted terms, while the average income of the bottom 90 percent of Americans stagnated, growing just 8 percent over this 30-year period."

Lawrence Mishel at the Economic Policy Institute states, May 3, 2012, "From 1978–2011, CEO compensation grew more than 725 percent, substantially more than the stock market and remarkably more than the annual compensation of a typical private-sector worker, which grew a meager 5.7 percent."

"Top 1 percent incomes grew by 58% from 1993 to 2010 (implying a 2.7% annual growth rate). This implies that top 1 percent incomes captured slightly more than half of the overall economic growth of real incomes per family over the period 1993-2010." (page 3) This 17 year period is demonstrative of the 28 year period the CBO report reports on. The statement comes from University of California professor Emmanuel Saez' report Striking It Richer. Since the official end of the Recession in June 2009 he says, "Hence, the top 1% captured 93% of the income gains in the first year of recovery. Such an uneven recovery can help explain the recent public demonstrations against inequality." (page 4) His graph, Figure 1, shows the increase of income share received by the top 10%, and the top 1%, Figure 2.

The Income Pie -- Portions Change

Returning to the CBO report, the top 1% increased from 8% to 17% --- a 9% shift in share size --- its post-tax and post-transfer income share over the period 1979 to 2007. (page xiii). All the 9% share came at a loss of share size from the lower-earning 80% of households, 94.4 million households. And in today's dollars, 9% of personal income is $1.032 trillion. Divided evenly among the 94.4 million households in the lower 80% who in 1979 received that income share, each household would increase its income by $10,933. The Recession would be over.

Growth of household debt

Christian Weller in an article in Challenge magazine, January 2012, shows in Figure 1 a graph of Household Debt to After-Tax Income, 1952 -2011. Between 1962 and 1985, the debt level ranged between 60% and 65%. Between 1990 and 200 the debt level increased from 80% to 90%. After 2000 to 2007 it exploded from 90% to 130%. Since 2007 it has receded to 114%. From Weller's article:

Between March 2001 to December 2007 "the debt burden increased at an unprecedented rate during the last business cycle, laying the foundation for a lot of economic pain to follow." (See his economic shapshot.)

"The implications for the current tepid economic recovery are huge. High household indebtedness is one factor that holds back consumption growth in the recovery and thus impedes faster economic growth and more hiring. . . . But consumption growth amounted to a total of only 4.3 percent for the first eight quarters of this recovery [to mid 2011], which is the slowest growth rate for any recovery of this length since World War II." He mentions that not until 2036 will debt levels return to below 90% given very high rates of income growth and normal growth rates for debt. The household savings rate has sunk to low levels recently, around 3.4%. See this graph at the St. Louis Federal Reserve.

http://research.stlouisfed.org/fred2/series/PSAVERT

Weller proposes remedies for debt relief, but he says "The benefits from faster income growth are larger than from refinancing, since interest rates cannot fall much further from where they are now." He proposes "boosting after-tax incomes through faster job creation by [government] investing in infrastructure." Omitting the word "government" is a mistake. Nouriel Roubini's "The Way Forward", the Progressive Caucus's budget, the Economic Policy Institute's proposal, Philip Harvey's "Back to Work", are all plans for robust government job creation programs that would aid the economy more than refinancing solutions which also are needed.

Finance Conquers the U.S. Economy

William Tabb's book The Restructuring of Capitalism in Our Time states, "In 1980 the total value of world financial assets was $12 trillion, about equal to global GDP, . . . In 2005 it was more than three times global GDP (McKinsey & Company 2006:9)." The U.S. finance sector led the way in expansion. During this time finance expanded 4.5 times faster than the GDP per capita. This was a train wreck in slow motion. "Corporate profits from the financial sector of the U.S. economy in 2004 were . . . 40 percent of all domestic corporate profits that year. They had been less than 2 percent of total domestic corporate profits forty years earlier [in 1964]." (page 14)

Corporate Profits --

"the highest proportion ever recorded"

Floyd Norris reported in the New York Times, August 5, 2011, "Nonetheless, President John F. Kennedy’s observation that a rising tide lifts all boats is no longer as true as it once was.

http://www.nytimes.com/2011/08/06/business/workers-wages-chasing-corporate-profits-off-the-charts.html?_r=1

Floyd Norris states,

"The new figures indicate that corporate profits accounted for 14 percent of the total national income in 2010, the highest proportion ever recorded. . . . The 2010 total [compensation including wages, salaries and benefits], of 62.1 percent, is not close to the record low share of 54.5 percent, set in 1929, the first year for which numbers are available. But it is the lowest for any full year since 1965" Norris continues, "Nonetheless, President John F. Kennedy’s observation that a rising tide lifts all boats is no longer as true as it once was.

There have been 10 years when corporate profits as a share of national income exceeded 13 percent — 1941, ’42, ’43, ’50, ’51, ’55, ’65, ’66, 2006 and 2010. In eight of those years, the economy, as measured by real gross national product, grew at a rate of greater than 6 percent.

The exceptions were 2006, when real growth was just 2.7 percent, and 2010, when it was 3 percent."

Andrew Sum reports, between 2000 and 2010, "The median real weekly earnings of the nation's full-time wage and salary workers rose by only slightly more than 2% over the decade. . . . real output per hour of work in the nonfarm business sector increased by slightly more than 29%, its best record since the decade of the 1960s. . . . corporate profits (before tax) increased in real terms (in constant 1999 dollars) by $470 billion or 58%." (Hint: 2 times 29 = 58. You can make a formula, a 2% rise in weekly earnings times a 29% increase in productivity equals a 58% increase in corporate profits. Professor Sum summed up the decade: "Over the past ten years, the US economy has performed more poorly on every key output, employment, wage and salary, and household/family income measure than at any time since the Great Depression of the 1930s." This is the picture of non-sharing.

The Economics of Greed.

The State of Working America draws much the same conclusion under their topic of "wages", see the source.

And a graph from Floyd Norris' article from the NYTimes:

|

TED Video on Economics

Nick Hanuer presented a talk at the TED forum which later was censored from its site. Later it was re-instated at YouTube. The content of the talk mirrors much that I have argued about taxation, job growth, income distribution.

http://www.youtube.com/watch?v=bBx2Y5HhplI

James Carville and Stan Greenberg new book

It's the Middle Class, Stupid" is the title of their new book. Carville's article in the WSJ says,

"The actual solution to our economic situation is straightforward: increased government spending, well in excess of what the 2009 Recovery Act contemplated and what a tea party-dominated Congress would now allow."

Read the Wall Street Journal article here.

Romney and His Plan

My friend's teen-age daughter came home distraught. The teen said her best friend's family had met over the weekend and decided that they were all supporting Romney. What I might say to her daughter? The Center for Budget and Policy Priorities says of Romney's budget cutting plan, "non-defense programs other than Social Security would have to be cut 29 percent in 2016 and 59 percent in 2022 (see Figure 1)." This means all government including Medicare and Medicaid would be 40% of today's size, with the exception of the military and Social Security, if Romney gets his way. Half of Medicaid goes to senior citizens in nursing homes. What a disaster this plan would be. Literally a horror. People would be dying on the sidewalks. In my opinion his plan would destroy government as we know it.

http://www.cbpp.org/cms/index.cfm?fa=view&id=3658

In September, 2011, Obama released a plan to increase private sector hiring. I view it as a tepid plan.

The New York Times has an article. A better resume may be this article at Reuters. Though the expense would be $447 billion, the funds dedicated to creating new jobs is about $100 billion.

Read more: http://swampland.time.com/2012/07/11/the-green-team-jill-steins-third-party-bid-to-shake-up-2012/#ixzz22Wr63kT2

The Green New Deal is a plan full of new rights: the right to employment, at a living wage, quality health care, tuition free education, affordable housing and utilities, and fair taxation. It proposes creating 16 million jobs in energy retrofits and the like, reducing military spending by 50%, restructuring the financial system, and the electoral system, one point is to create a national holiday on election day.

Now Jill Stein's plan I can endorse (she is the Green Party candidate), but I may write in the name of Representative Jan Schakowsky of Illinois for her courageous budget proposal as a member of the "Bowles-Simpson" committee on the deficit.

|

Justice Party presidential candidate Rocky Anderson. (Photo courtesy of Rocky Anderson)

Justice Party presidential candidate Rocky Anderson. (Photo courtesy of Rocky Anderson)

Rocky Anderson has a long interview-article at TruthOut, see this site. I found it too long to read so I copied the text onto TextEdit, an apple word processing program, and then I had my computer read aloud the article. It's sad that we are stuck with just two front-runners (Obama and Romney) who are lost causes. Broken promises such as Employee Free Choice Act, renegotiate free trade agreements, remove the cap on social security, single payer health care, higher minimum wage, and the entire history of mismanaging the banking crisis-scandal -- is why I and many cannot support Obama. The new book The New New Deal by Michael Grunwald presents the Obama presidency in a fresh and positive light, so I may revise my viewpoint here, but I doubt it.

I believe our present economic system is outdated, potentially lethal to future humanity (given the likelihood of global climate warming of 4 to 9 degrees F. by 2100 -- this links to a National Research Council report). Our economic assumptions are a tragic historical misfit, wasteful of human resources in the extreme, and inequality is the end result of this extreme wastefulness. Here's a site, After Capitalism, with George Manbiot's thoughts about a new configuration of our economic lives. Remember, wealth is extremely polarized as reported by the Credit Suisse bank's World Wealth Report for 2011. Allowing resources to ONLY be allocated by reasonable profit motives is not efficient, nor does it serve humanity. From page 10:

"The bottom half of the global population together possess barely 1% of global wealth, although wealth is growing fast for some members of this segment. In sharp contrast, the richest 10% own 84% of the world's wealth, with the top 1% alone accounting for 44% of global assets."

Imagine what could be done if we allocated to productive public use much of this wealth? Such allocation would not be theft, it would be a commitment to the well-fare of all. It would democratically redefine our social dependency.

I wrote two Solutions essays, February 2012 and February 2011. If you have read this far, you might be curious to read two comprehensive solutions that cite various professional plans. Like nearly all of my writing, I draw on others' research.

I believe our present economic system is outdated, potentially lethal to future humanity (given the likelihood of global climate warming of 4 to 9 degrees F. by 2100 -- this links to a National Research Council report). Our economic assumptions are a tragic historical misfit, wasteful of human resources in the extreme, and inequality is the end result of this extreme wastefulness. Here's a site, After Capitalism, with George Manbiot's thoughts about a new configuration of our economic lives. Remember, wealth is extremely polarized as reported by the Credit Suisse bank's World Wealth Report for 2011. Allowing resources to ONLY be allocated by reasonable profit motives is not efficient, nor does it serve humanity. From page 10:

"The bottom half of the global population together possess barely 1% of global wealth, although wealth is growing fast for some members of this segment. In sharp contrast, the richest 10% own 84% of the world's wealth, with the top 1% alone accounting for 44% of global assets."

Imagine what could be done if we allocated to productive public use much of this wealth? Such allocation would not be theft, it would be a commitment to the well-fare of all. It would democratically redefine our social dependency.

I wrote two Solutions essays, February 2012 and February 2011. If you have read this far, you might be curious to read two comprehensive solutions that cite various professional plans. Like nearly all of my writing, I draw on others' research.

4 comments:

Mr. Leet! I just saw a comment you left at alternet and I rushed right over here to learn more about you. It is an enormous pleasure to learn you exist, Sir! Thank-you so very much for your excellent work! You cause me to recall (for the one millionth time in me littlelong life) the good and wise Dr. Leete - who teaches and enlightens Julian West in Edward Bellamy's exquisite "Looking Backwards" and his even better sequel "Equality"...I suspect you probably know them...what a shame so few people do these days.

USAmerica has sadly forgotten all of her best past thinkers. "Progress and Poverty? Henry George? Nope, never heard of 'em, but then I don't much like to read anyway so I mostly stick to just the sports page."

Mr. Leet, do you ever feel like tearing your hair out when you try to get people to discuss the giga-extreme, giga-harmful, giga-illogical and irrational economic inequality injustice we've got going on here on planet Earth? Aren't you just gobsmacked by how utterly relaxed everyone is in the face of the escalating horrors and dangers going on all around us? Has our species lost all survival instinct? What makes people today think they have some right to grant themselves license to ignore lethal mal-distribution killing millions of human beings per year? Why has extreme wealth never been universally condemned? Why don't people say to the billionaires "Hey, I work as hard as you do, you can't have more pay for your work than I get for mine!"

I am a very early subscriber to Sam Pizzigati's Too Much, I eagerly read Professsor Michael Hudson and William Black from UofMO KC, I am the most well-informed, realistic and rational person I know, I long ago made it my serious business to learn every last thing I could about what isn't true in economics. And I am now keenly interested in getting your opinion on some new and very big-picture economic thinking I have written. Would it be alright with you, Mr. Leet, if I post a link to what I've written in these comments at your place? Or, could I send you a piece called "The Plan" in email, perhaps?

Thanks again for your work, Dr. - erhm, I mean Mr. Leet!

Be well and keep well is my wish to you and yours, Sir

Dr. Anonymous, thanks for the encouragement. Mr. Pizzigati writes a great weekly newsletter. Why don't you just post the link on the comment area, don't send me an e-mail. Tx. B. L.

Thanks, Mr. Leet. The writing is here, at a forum belonging to a cyber acquaintance of mine:

http://peaceonearth.myfreeforum.org/about1100.html

Top of that page is a draft of chapter 2 of a book on fairpay I'm trying to finish, but if you scroll about halfway down the page there's an essay called The Plan. It's that essay I hope you will like, and I'd love to get your feedback on it. If you like, you you can reach me at payjustice at fastmail dot fm - and thanks very much in advance for reading it if you will, Sir. (my name in that place is Xavier Onassis, but there are other XO's around the web, I have discovered, so please don't assume they are all me.)

Would it be rude of me to inquire whether you have found the time to read my 'The Plan', Mr. Leet?

Post a Comment