There has been a net zero increase in private sector jobs in the U.S.A. since November 1999, twelve years ago. One may go to this Bureau of Labor Statistics web page and construct the table and graph that shows this crisis. Click the second box at this BLS site. An then construct your graph, 1999 to 2011. The BLS re-works their web page, and doing so they destroy the graph on this blog. I try to patch it back in place every week. Instructions to create graph are just below.

In December, 1999, total of 109,992,000 private sector workers, in December 2011 109,928,000 workers, 64,000 fewer after 12 years. (If the BLS web page is closed, you can "google" "BLS databases", click "Employment" then click "Employment Hours and Earnings - National, Top Picks" and check the second box on the list, "Total Private Employment, CES0500000001". Then arrange for a graph showing the years 1999 to 2011.)

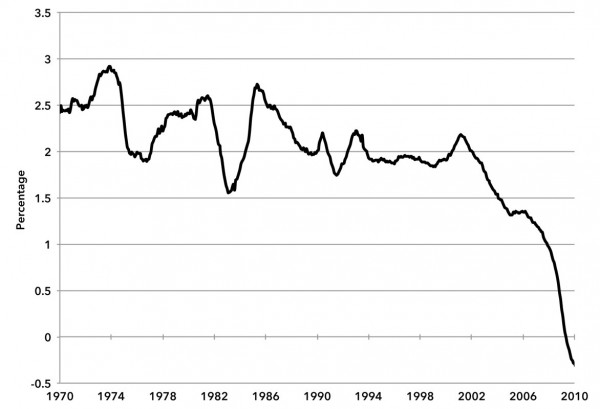

I'm going to place another graph from an article in The Monthly Review, June 2011, by Fred Magdoff, "The Jobs Disaster in the United States." This graph is a ten year moving average graph. Note the horizontal axis zero line as the rate line crosses it in 2009. The Magdoff article is a better read than this blog article you are now reading.

The graph from the St. Louis Federal Reserve:

________________________________________________

2007 - 2012

Between January 2007 and December 2011 the working age population has increased by 8,717,000, yet the labor force has increased by only 743,000. And the number working is down by 5,238,000.

(Details from two sources: http://www.bls.gov/news.release/empsit.t01.htm, and http://www.bls.gov/cps/cpsaat1.pdf. The working age population increased from 231,887,000 to 240,584,000 an increase of 8,717,000, Jan. 2007 to Dec. 2011. See "Employment, Hours, and Earnings from the Current Employment Statistics survey (National)" Total private, Series Id: CES050000001).

Hughes and Seneca, from Rutgers University, first reported this job-loss trend in "America's New Post-Recession Employment Arithmetic" in September 2009, stating,

"To put this new millennium experience into perspective, during the final two decades of the twentieth century [1980 - 2000], the nation gained a total of 35.5 million private-sector jobs. During the current decade [2000 - 2010], America appears destined to lose more than 1.7 million private-sector jobs."

The BLS web page shows Total Non-farm employment Dec. 1999 to Dec 2011, 12 years, an increase of 1.368 million. And Government employment Dec. 1999 to Dec. 2011, 12 years, an increase of 1.432 million. All the job increase in the economy over 12 years derives from increases in government employment.

____________________________________________________

I left an e-mail with a certain economist, and I will copy it here to explain.

At the Bureau of Labor Statistics you can read that 12 years ago there were the same number of private sector jobs in the U.S. as today, 109.7 million today and 109.7 million in Nov. 1999. No net job growth over 12 years in private sector employment. Between 1990 and 2000 the labor force grew by 13.1%, so one would think in the past 12 years the private job sector would have grown at the least by 13.1% creating 14 million new private sector jobs. But the 12 year growth rate has been absolutely flat. No job growth. There should be at least 124 million private sector jobs, but we have in Nov. 2011 only 109.7 million. What has happened?

Also consider the report at National Jobs for All Coalition, unemployment. Add all the unemployed, the under-employed and those working full-time and full-year for below poverty level income, and you arrive at --- 29.6%, almost 30% of the workforce of 154 million adult workers. That would be over 45 million adults just squeaking along. No wonder that one recent report states that one third the families in the nation are either officially poor or "near" poor, meaning incomes of no more than 150% of the poverty level. See this article and graph from a New York Times article:

The Social Security Administration in 2010 reported that half of U.S. workers (75 million workers) had an annual income of less than $26,362. Then consider that our economy generates over $47,000 per person and over $109,000 per worker. It could make you sick! It makes no sense.

I recommend Nouriel Roubini's report "The Way Forward" at the New America Foundation. Two co-authors, Daniel Albert and Robert Hockett, contributed. Their jobs proposal would create "A $1.2 trillion, Five-Year Public Investment Program targeting high return investment in energy, transportation, education, research-and-technology-development, and water-treatment infrastructure." This is "Pillar One" of their proposal; Pillar Two is devoted to "Debt Restructuring and Regulatory Capital Loss Absorption" to repair housing and financial debt overhang; and Pillar Three addresses "Global Rebalancing -- A New G-20 Commitment to Currency Realignment, Domestic Demand Growth and Reduction of Current Account Surpluses. . . ". The comprehensive reform proposal is the most realistic "Way Forward" I have read. You can listen to an audio or watch a video presentation by the three authors at this site. It's 2 hours long, but pretty interesting, but not as good as the paper. Take a look, not Masterpiece Theater, but a great discussion.

My own "solutions" essay is February 2011's essay, found here.

A similar proposal, Investing in America's Economy, November 2011, comes from the Economic Policy Institute, Demos, and The Century Foundation. From its summary: "3.Build on economy-boosting investments. We must build and maintain initiatives that directly support long-term job and economic growth. Failing to invest adequately in these efforts – or sacrificing them to short-term deficit reduction – would be a dereliction of sound public management." The report suggests public investment in Child Care Services, Early Childhood Education, Infrastructure, Public Transit (high speed railroads), Rural Broadband Connectivity, Basic Research and Development.

The article America Beyond Capitalism by Gar Alperovitz shows the ultimate democratization of the economy which would drastically and dramatically reconstitute our economic lives through worker owned enterprise. Our lot in America will never be systemically improved until workers make decisions regarding allocation of resources. From the article America Beyond Capitalism at Dollars and Sense Magazine, December 2011:

"A mere one percent at the top now owns roughly half of the nation’s investment capital—more wealth than the entire bottom half of society taken together. This is literally a medieval pattern of ownership. Worker co-ops are one way to offer a practical alternative to this pattern, but they are not the only way."

Richard Wolff, emeritus professor economics, publishes at his own web page, and offers the same advice as Alperovitz: democratize the workplace. He spoke on January 12, 2012 in Berkeley and his lecture will soon be broadcast and available on KPFA radio.

The Levy Economic Institute assures us that this is Not Your Father's Recession. The scholars at PERI recently released a proposal that would create 19 million jobs by 2014. The Economic Policy Institute also advocates federal job creation, (see also this) as do many others such as this one at Demos.org by Rutgers professor Philip Harvey.

Robin Hahnel has been promoting a Parecon economy for decades and his video is accessible here.

A good summary of the poverty of "mainstream" advice can be found here, the article Capitalism in Crisis -- the Apologia. In the same vein, Jack Rasmus' articles, here, consistently analyze the shortcomings of mainstream advice. And Dean Baker's articles are found here. With all these sources a reader can fill up his or her day. Good luck.

http://www.bls.gov/cps/cpsaat1.pdf --

and BLS 1940 to 2010 Employment Status Report -- where I took my info

From: http://www.floridatoday.com/content/blogs/jparker/labels/unemployment.shtml

From: http://www.floridatoday.com/content/blogs/jparker/labels/unemployment.shtml

_________________________________

From my blog, August 2011. --- though it may seem hopelessly confusing:

Between the years 2000 - 2010 the civilian non-institutional population grew by 11.9%

(some 25,253,000 added, from 212 million to 237 million).

The civilian labor force grew by 7.9% (some 11,306,000, from 142 million to 153 million).

This says that of the increase in the population of potential workers (25 million), 44.8% entered the labor force (11 million), and 55.2% (14 million) did not enter the labor force.

The employed civilian labor force grew by 1.6% (some 2,173,000, from 136,891,000 to 139,064,000). (My confusion here has to do with the ages of those who decided not to participate in the labor force. I imagine that most of the missing participation occurred with older workers, a slow discouragement led to a persistent leakage out of the work force -- that's my guess.)

Out of the 25 million increase in civilian non-institutional population, 8.6% found jobs, and 91.4% did not find jobs. 25 million were added to the first (population), 2.2 million were added to the second (jobs). Restated: For every 12 people added to the population of potential workers, 1 job was added to the total employed! And those were government jobs, not private sector jobs. !!! Crisis?

In December, 1999, total of 109,992,000 private sector workers, in December 2011 109,928,000 workers, 64,000 fewer after 12 years. (If the BLS web page is closed, you can "google" "BLS databases", click "Employment" then click "Employment Hours and Earnings - National, Top Picks" and check the second box on the list, "Total Private Employment, CES0500000001". Then arrange for a graph showing the years 1999 to 2011.)

I'm going to place another graph from an article in The Monthly Review, June 2011, by Fred Magdoff, "The Jobs Disaster in the United States." This graph is a ten year moving average graph. Note the horizontal axis zero line as the rate line crosses it in 2009. The Magdoff article is a better read than this blog article you are now reading.

Source: Calculated from All Employees: Total Private Industries (USPRIV), downloaded from St. Louis Federal Reserve FRED database, http://research.stlouisfed.org.

30 million potential workers increased the work-age population 1999 to 2010, from 207 million to 237 million. (See this BLS site for confirmation. Choose Database Tools, Top Picks, Total Non-farm employment) Of this increase it's normal for 2 of 3 to join the work force, or 20 million. Of this increase of 20 million there was no net increase in private sector jobs --- None. Only government sector jobs were created. Is this a crisis? Leakage out of the work force occurs at all ages. But the young workers entering the working age population are hardest hit. See the BLS link at the bottom of the next paragraphs.The graph from the St. Louis Federal Reserve:

________________________________________________

2007 - 2012

Between January 2007 and December 2011 the working age population has increased by 8,717,000, yet the labor force has increased by only 743,000. And the number working is down by 5,238,000.

1997 - 2012

Between January 1997 and December 2011 the working age population has increased by 37,451,000, the labor force by 18,431,000, and the employed workers by 12,492,000. This indicates that during this 15 year period for every 100 added to the working age population only 33.335 found work. 66 did not find work.

(Details from two sources: http://www.bls.gov/news.release/empsit.t01.htm, and http://www.bls.gov/cps/cpsaat1.pdf. The working age population increased from 231,887,000 to 240,584,000 an increase of 8,717,000, Jan. 2007 to Dec. 2011. See "Employment, Hours, and Earnings from the Current Employment Statistics survey (National)" Total private, Series Id: CES050000001).

Hughes and Seneca, from Rutgers University, first reported this job-loss trend in "America's New Post-Recession Employment Arithmetic" in September 2009, stating,

"To put this new millennium experience into perspective, during the final two decades of the twentieth century [1980 - 2000], the nation gained a total of 35.5 million private-sector jobs. During the current decade [2000 - 2010], America appears destined to lose more than 1.7 million private-sector jobs."

The BLS web page shows Total Non-farm employment Dec. 1999 to Dec 2011, 12 years, an increase of 1.368 million. And Government employment Dec. 1999 to Dec. 2011, 12 years, an increase of 1.432 million. All the job increase in the economy over 12 years derives from increases in government employment.

I left an e-mail with a certain economist, and I will copy it here to explain.

At the Bureau of Labor Statistics you can read that 12 years ago there were the same number of private sector jobs in the U.S. as today, 109.7 million today and 109.7 million in Nov. 1999. No net job growth over 12 years in private sector employment. Between 1990 and 2000 the labor force grew by 13.1%, so one would think in the past 12 years the private job sector would have grown at the least by 13.1% creating 14 million new private sector jobs. But the 12 year growth rate has been absolutely flat. No job growth. There should be at least 124 million private sector jobs, but we have in Nov. 2011 only 109.7 million. What has happened?

Also consider the report at National Jobs for All Coalition, unemployment. Add all the unemployed, the under-employed and those working full-time and full-year for below poverty level income, and you arrive at --- 29.6%, almost 30% of the workforce of 154 million adult workers. That would be over 45 million adults just squeaking along. No wonder that one recent report states that one third the families in the nation are either officially poor or "near" poor, meaning incomes of no more than 150% of the poverty level. See this article and graph from a New York Times article:

The Social Security Administration in 2010 reported that half of U.S. workers (75 million workers) had an annual income of less than $26,362. Then consider that our economy generates over $47,000 per person and over $109,000 per worker. It could make you sick! It makes no sense.

I recommend Nouriel Roubini's report "The Way Forward" at the New America Foundation. Two co-authors, Daniel Albert and Robert Hockett, contributed. Their jobs proposal would create "A $1.2 trillion, Five-Year Public Investment Program targeting high return investment in energy, transportation, education, research-and-technology-development, and water-treatment infrastructure." This is "Pillar One" of their proposal; Pillar Two is devoted to "Debt Restructuring and Regulatory Capital Loss Absorption" to repair housing and financial debt overhang; and Pillar Three addresses "Global Rebalancing -- A New G-20 Commitment to Currency Realignment, Domestic Demand Growth and Reduction of Current Account Surpluses. . . ". The comprehensive reform proposal is the most realistic "Way Forward" I have read. You can listen to an audio or watch a video presentation by the three authors at this site. It's 2 hours long, but pretty interesting, but not as good as the paper. Take a look, not Masterpiece Theater, but a great discussion.

My own "solutions" essay is February 2011's essay, found here.

A similar proposal, Investing in America's Economy, November 2011, comes from the Economic Policy Institute, Demos, and The Century Foundation. From its summary: "3.Build on economy-boosting investments. We must build and maintain initiatives that directly support long-term job and economic growth. Failing to invest adequately in these efforts – or sacrificing them to short-term deficit reduction – would be a dereliction of sound public management." The report suggests public investment in Child Care Services, Early Childhood Education, Infrastructure, Public Transit (high speed railroads), Rural Broadband Connectivity, Basic Research and Development.

The article America Beyond Capitalism by Gar Alperovitz shows the ultimate democratization of the economy which would drastically and dramatically reconstitute our economic lives through worker owned enterprise. Our lot in America will never be systemically improved until workers make decisions regarding allocation of resources. From the article America Beyond Capitalism at Dollars and Sense Magazine, December 2011:

"A mere one percent at the top now owns roughly half of the nation’s investment capital—more wealth than the entire bottom half of society taken together. This is literally a medieval pattern of ownership. Worker co-ops are one way to offer a practical alternative to this pattern, but they are not the only way."

Richard Wolff, emeritus professor economics, publishes at his own web page, and offers the same advice as Alperovitz: democratize the workplace. He spoke on January 12, 2012 in Berkeley and his lecture will soon be broadcast and available on KPFA radio.

The Levy Economic Institute assures us that this is Not Your Father's Recession. The scholars at PERI recently released a proposal that would create 19 million jobs by 2014. The Economic Policy Institute also advocates federal job creation, (see also this) as do many others such as this one at Demos.org by Rutgers professor Philip Harvey.

Robin Hahnel has been promoting a Parecon economy for decades and his video is accessible here.

A good summary of the poverty of "mainstream" advice can be found here, the article Capitalism in Crisis -- the Apologia. In the same vein, Jack Rasmus' articles, here, consistently analyze the shortcomings of mainstream advice. And Dean Baker's articles are found here. With all these sources a reader can fill up his or her day. Good luck.

http://www.bls.gov/cps/cpsaat1.pdf --

and BLS 1940 to 2010 Employment Status Report -- where I took my info

From: http://www.floridatoday.com/content/blogs/jparker/labels/unemployment.shtml

From: http://www.floridatoday.com/content/blogs/jparker/labels/unemployment.shtml_________________________________

From my blog, August 2011. --- though it may seem hopelessly confusing:

Between the years 2000 - 2010 the civilian non-institutional population grew by 11.9%

(some 25,253,000 added, from 212 million to 237 million).

The civilian labor force grew by 7.9% (some 11,306,000, from 142 million to 153 million).

This says that of the increase in the population of potential workers (25 million), 44.8% entered the labor force (11 million), and 55.2% (14 million) did not enter the labor force.

The employed civilian labor force grew by 1.6% (some 2,173,000, from 136,891,000 to 139,064,000). (My confusion here has to do with the ages of those who decided not to participate in the labor force. I imagine that most of the missing participation occurred with older workers, a slow discouragement led to a persistent leakage out of the work force -- that's my guess.)

Out of the 25 million increase in civilian non-institutional population, 8.6% found jobs, and 91.4% did not find jobs. 25 million were added to the first (population), 2.2 million were added to the second (jobs). Restated: For every 12 people added to the population of potential workers, 1 job was added to the total employed! And those were government jobs, not private sector jobs. !!! Crisis?

dailycaller.com

Similar ‑ More sizes