Trump’s One Good Idea

In 1999 Mr. Trump was running for president and broadcasting his ideas about the national debt. A November, 1999, article begins, “Billionaire businessman Donald Trump has a plan to pay off the national debt, grant a middle class a tax cut, and keep Social Security afloat: tax rich people like himself. . . . By Trump's calculations, his proposed 14.25 percent levy on such net worth [on individuals with net worth over $10 million] would raise $5.7 trillion and wipe out the debt in one full swoop. . . . ‘Personally this plan would cost me hundreds of millions of dollars, but in all honesty, it's worth it,’ Trump said. ”

This might be Trump’s only good idea, I don’t know. In the article he called our capital “Disneyland-on-the-Potomac,” showing his flair for denigrating and humorous statements was alive back then. This “fell swoop” plan is absent in his present proposals. A 2015 article states that the head of the Committee for a Responsible Federal Budget “estimates Trump's tax plan would increase public debt to 125% of the size of the economy by 2025, up from 74% today.” The very professional Tax Policy Center states that Trump’s current plan would increase the debt from its present $18 trillion to $33 trillion by 2036. Apparently Donald has parked his first “fell swoop” proposal.

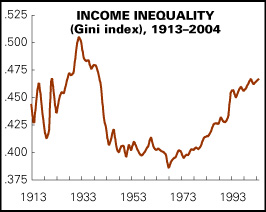

I believe the controversy over the federal budget and the national debt is crucial to restoring prosperity to all Americans and should be a focus issue for all voters. Presently the average household annual pre-tax income is almost $100,000 (see here, page 2), and the average net worth is $700,000 (see here, also on page 2). But averages are misleading; the median household income in 2015 was $53,657 (the same level as 1996) and median net worth stands at $81,450 (less than it was in 1989). This is not shared prosperity. In the past 8 years total household net worth has increased by a nominal 55%, from $56 trillion to $87 trillion (see page 2). This is equal to an added wealth gain of $250,000 per household. But our prosperity is not shared. The top one percent, some 1.2 million households, together own $36 million millions, over $36 trillion, some 42% of all private savings (see here, page 42), averaging $30 million in savings (net worth) per household. The lower-saving half of U.S. households own 1.1% of all wealth.

Perversely, during the past 8 years the median household's net worth has dropped by 40%. Since 1996 personal "disposable income" per capita has increased by 40%, since 1986 by 61%. But this too is a misleading average; the "Average Weekly Earnings of Production and Nonsupervisory Employees", 80% of all workers, is up 3% after 54 years, while the disposable income per capita has tripled, up 200%. The richest one percent received 19% of all income in 2015, and owned 42% of all private savings. These last paragraphs should shock a careful reader. The numbers tend to blur in the mind, so I hope you have re-read it slowly.

A Trump plan to eliminate the national debt would be very feasible, since the debt is $18.4 trillion, and the national private savings is $86.8 trillion (see here, page i). The Public Debt, owed to private investors and foreign governments, is $13.8 trillion, one sixth the amount of U.S. private household net worth. This means the old Trump plan, the "fell swoop" at 14% would almost wipe out the Public Debt.

My Congressman, Tom McClintock, and his Republican clan, are calling for drastic spending cuts in order to balance the budget. Raising taxes is off the table. Taxing private wealth is beyond his imagination. A financial transaction tax is adamantly opposed. My neighbor and I walk around together for exercise. He votes for McClintock because McClintock will balance the budget. You probably have many neighbors who do the same. I think Democrats should be able to explain why this Republican austerity program is a disaster.

This graph -- from the Economic Policy Institute -- and this NYTimes article -- and see graphs below, Nov. 2015, this blog, the Unemployment Story, Again -- show that government spending in the wake of economic recessions has plummeted since 2009.

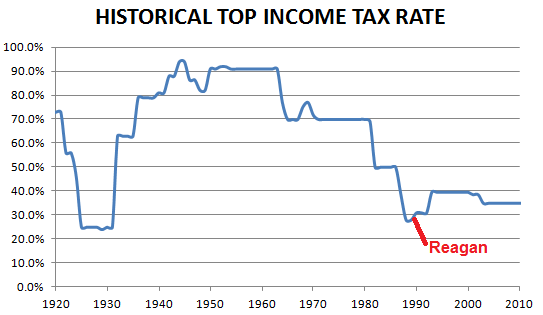

For 20 years, 1943 to 1963, the top marginal income tax rate was 90% on income that exceeded $1.6 million annually. For fifty years, 1930 to 1980, the average top income tax rate averaged 82%, see this article. During those 50 years the economic growth rate has never been surpassed, and prosperity enabled family income to double (inflation adjusted) at all income levels between 1946 and 1976. Between 1950 to 1970 the federal debt dropped from 90% of GDP to under 40%, even though the national budget was in deficit 15 of those 20 years (see Table 1.2, here). And infrastructure projects such as the Interstate Highway system and NASA’s Apollo project were paid for.

Austerity does not work. We have to repair the economy by spending intelligently. This may sound counter-intuitive, but it has worked successfully since FDR lowered the unemployment rate, 1933 to 1937, from 25% to 9.6%. Spending by government has increased prosperity, and deficits are manageable with shared growth, which we do not now have.

_________________________________________________

Since writing this piece two excellent articles have appeared. "Thomas Piketty on the Rise of Bernie Sanders", and an article by Robert Pollin, "Bernie Sanders Will Make the Economy Great Again." They capsulize the economic drama the nation faces. Sanders represents a stark and much needed break from the 1980s to the present. A quick education is available by reading these two pieces. What the two authors leave out is the need to change the National Labor Relations Act of 1935, and that of 1947, which would free up labor to win greater incomes from the corporations most workers work for -- this shift would change the inequality trend and bring about a shared prosperity.

.jpg)