Solutions — The Way Forward

To Shared Prosperity

The problem:

The CBO report on income distribution is stark, but the report by Saez, Piketty and Zucman, 2016, is starker.

This graph came from the CBO, income distribution before taxes in 2011.

And from the Saez, et al report that how the lower 50% lost while the top 1% gained, this graph:

From the report:

From 1980 to 2014, for example, none of the growth in per-adult national income went to the bottom 50 percent, while 32 percent went to the middle class (defined as adults between the median and the 90th percentile), 68 percent to the top 10 percent, and 36 percent to the top 1 percent. An economy that fails to deliver growth for half of its people for an entire generation is bound to generate discontent with the status quo and a rejection of establishment politics.

No growth to lower half;

about a third to the 50 to 90 percentiles,

and about a third to 90 to 99 percentiles.

about a third to the top 1%,

I find myself mentally pursuing solutions. The world has to react to the presidential and Congressional realities, but perhaps we are forgetting the evolution of positive outcomes. Here is my list of 14 solutions to transform the economy worldwide, no small ambition.

The 14 Solutions

1. Get money out of politics.

1. Get money out of politics.

This report, Table 2, page 51, shows that donations of $10,000 or larger were the biggest contributor in the 2016 presidential contest. It breaks donation amounts into 7 sizes, from less than $200 to over $100,000 in the 2016 presidential election. Hillary Clinton received 60.0% of her donations in amounts greater $10,000, Trump 47.1%, and Sanders 4.8%. Sanders was obviously the people's candidate. I remember watching the World Series that year, and anti-Hillary advertising was blanketing the between innings advertising slots. Big money spent late in the race, this report states, played a very large role in the election. What chance does a tax increase on the rich have when the wealthiest pay for, or buy, our candidates? Thomas Ferguson, and Open Secret, and others have information about this, and Represent.Us has 10 reforms. Here is a crisp video on election corruption from Represent.Us -- this video is convincing and right on, you should click now -- and here is the anti-corruption act site. You can download the act itself. Incumbents win re-election 90% of the time, they collect over 80% of all donations, and almost half of the time they outspend their opponent by 10 to 1 --- all this in charts at the Open Secrets site, here. Money calls the shots, and here's Lawrence Lessig at Ted Talks video, presenting a clear picture about the 0.02% who determine our democratic (?) system.

2. End "Financialism", a mutant off-spring of capitalism, the parasite that is destroying the host. Finance is destroying capitalism, period.

Since 1986 financial assets have increased their value by 194%, that is almost tripling in value. They increased from $24 trillion to $72 trillion, adjusting for inflation (in comparison the national debt stands at $20 trillion in 2016). In the same period, GDP per capita rose by 56%. 56% vs. 194% -- This creates a disincentive for productive investment because investing in financial assets pays far more than normal economic growth.

Since the recession ended in June of 2009, the "real" household net worth - call it wealth - has increased by 64%, up from $48.9 trillion to $90.2 trillion. (See the FRB report, page 2, and Table B101) How, we should ask, is this possible? To create a stunning increase in total net worth during a period of recession? While the wealthiest six million households are now wealthier by over $5 million on average, even more millions of Americans lost their jobs and/or income and often their homes. Half of Americans live a precarious life indecent for such a wealthy nation. While most of the attention has gone to the federal budget -- national debt rose by $9 trillion to $19 trillion in the same period -- the real problem is the enrichment of a minority at the expense of the majority.

Most American families lost over 40% of their life savings.

Median household wealth, by race and ethnicity, 1983–2010 (2010 dollars)

The average household net worth is $721,000 (see FRB Flow of Funds, linked above)

Running in the opposite direction, financial wealth was booming. Something is wrong here?

The book Makers and Takers by Rana Foroohar targets unequivocally the financial system as the crippler of our economy. She cites a book by Adair Turner that claims 85% of corporate profits end up bolstering financial assets and 15% are applied to actual investment. And she cites (page 332) a study that "finds that the function of financial system . . . is no longer to funnel money to new investments, but to funnel it through existing assets, such as housing, often via complex securitization." (from an FRB paper by Schularick and Taylor, Credit Booms Gone Bust, 2009) From their conclusion: ". . . episodes of financial instability have more often than not been the result of credit booms gone wrong, most likely due to failures in the operation and/or regulation of the financial system. . . . For policymakers, a complacent attitude towards the growth in the scale and riskiness of the credit system now looks like a misguided choice that ignored history."

Foroohar's book is also easy to read as she was a journalist at Time magazine for 20 years or more. I've not finished it, but it's good so far. See her interview at INET.

John Kay, author of Other People's Money, states in an interview with the Financial Times, "that only three percent of British bank assets are to enterprises engaged in the production of goods and services. Most of the rest are loans to other banks. The primary activity of large banks is no longer financing growth in the real economy but 'exchanging bits of paper' with their peers, sometimes cutting the paper into different shapes in the name of 'innovation'." See his interview at Institute for New Economic Thinking.

"Capitalism is killing itself," states the expert in this interview. Another expert agrees. Watch this February, 2017, video interview at The Real News Network, where Paul Jay interviews Heiner Flassbeck, "Mountains of Uninvested Corporate Cash, Not Mexico, Most Responsible for Job Loss."

Flassbeck worked as an economist for the German government, then for the United Nations at UNCTAD, United Nations Council on Trade and Development.

Lawrence Mitchell, author of The Speculation Economy, has penned an accurate picture of this "financialism" parasite at his blog. His last installment, May 5, 2014, carries a paragraph "How can we fix it?" The details are not appropriate in this broader essay, but should be glanced at.

The U.S. and global economies suffer from a scandalous and enormous over-supply of unused capital. Daniel Alpert covers this in his book The Age of Oversupply, Overcoming the Greatest Challenge to the Global Economy, and in this shorter essay, Glut. Other authors have been writing about it here (David Korten), and here, (Robert Kuttner), and here (Michael Roberts). And read my comment at the end of this essay.

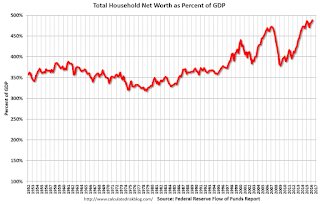

At the risk of cluttering my list, here's a graph showing the ratio of household net worth to GDP, at a historical high (see this web page). Today 70% of all U.S. assets are financial. See Flow of Funds, Table B.101.

Globally, private net worth exceeds $256 trillion according to Credit Suisse Bank. How much of this value is simply wasted, not put to productive use, squandered in speculation not investment? Most of it, perhaps 85% as Faroohar claims.

A Global View

What is a proper social response to this enormous pile of unused wealth? The Pew Research reports that in 2011 51% of humans (3.5 billion people) consumed or lived on less than $5 a day, and "at the end of the first decade of the 21st century, the vast majority of the world’s population (71%) [5 billion humans] remained either poor or low income", living on less than $10 a day. The Credit Suisse's wealth pyramid shows that 74% of the world's adults own 2.4% of total wealth, about $1,700 per adult. And they all survive at less than $10 a day. As for the poorer half of humankind, they consume annually $5 trillion of resources, 2% of the world's private net worth. This is a tragedy. A modest tax on these resources could improve the lot of half of all humans. The dynamics of "financialism" should be examined, and the incentives changed drastically. That's the purpose of this essay.

James Kwak, co-author of several books with Simon Johnson, here proposes a retrospective tax on capital.

And here is another proposal about a modest tax on billionaire's wealth.

I highly recommend this short report by L. Randall Wray which capsulizes the essential economic problem we face, "Minsky's Money Market Capitalism and the Global Financial Crisis".

* * * * * * * * * * * * * * * * * * * * *

The Way Finance Outpaces the Economy

I don't like to complicate matters, but ---- as usual I have to anyway. Here's how financial growth exceeds normal economic growth. In 31 years, 1986 to 2016, the nation saved about $20.5 trillion, but financial assets increased in value by $61 trillion. How is that possible? Instead of using this surplus to improve the quality of life, the wealthy minority place their gains into a finite number of paper products. When the economy's surplus is converted into hoarded savings and poured into this finite pool, the value of these limited assets (stocks and bonds) automatically increases. During the 1960s and '70s this did not happen. If you want proof of skimming off the top, read the Harvard Business Review article by Professor William Lazonick showing that 91% of the profits from the S&P 500 went to shareholder dividends and stock buybacks. Stock values in this condition become a parallel currency that increases faster than the actual currency and faster than the economy!

* * * * * * * * * * * * * * * * * * *

3. Tax Financial Transactions,

or, better, tax financial assets directly as a property tax.

The public part of the national debt of the federal government is $14 trillion, while 6 times greater at $90 trillion is the total household net worth, or savings net of debt. A current study shows the wealthiest 0.1%, or 160,000 families, own about $20 trillion in assets, or $122 million average wealth, mostly untaxed financial assets. The CPEG writers have offered a FTT plan that would raise $900 billion in new taxes; and they are trying to create an Illinois tax on the Chicago Board of Trading. Also James Kwak has authored a plan to tax financial assets directly. Kwak co-authored several books with Simon Johnson, economics professor at MIT. I imagine this is the best way to treat the economy's imbalance, and to also balance the federal budget: direct taxation of financial wealth. Of course a reworking of the long-term capital gains tax is much needed. And international trade should be conditioned on raising the incomes of all workers, not just on the efficiency of lower priced goods. It all fits together -- financialization is a global parasite. The Peter Barnes’ book, With Liberty and Dividends for All, also discusses a FTT.

3. Raise the Minimum Wage and Increase the Earned Income Tax Credit, EITC.

Senator Sherrod Brown (Ohio, Dem) and Rep. Ro Khanna propose to double the pay-out on the EITC, an annual pay bonus for low-income workers, benefitting over 20 million households in 2017. Doubling would increase the pay-out from $70 billion to $140 billion per year. Childless workers would finally be eligible for a decent benefit. At U.Mass/Amherst, scholar Jeanette Wicks-Lim in 2011 wrote a similar proposal, which I analyzed. How much income do the lower-earning half of American workers earn (81 million workers)? Less than 7% of all the national income says the Social Security Administration. They need a raise. See here and here, my blogspot web page.

4. Rewrite the National Labor Relations Act and make strikes effective again. Bernie Sanders in May, 2018, proposed an overhaul of the old labor laws that enables workers to form unions, make owners submit a contract, go to binding arbitration, and support secondary labor strikes. See also here. Ellen Dannin has a book on litigating the NLRA and reviving its original intent.

Others authors include Michael Yates, Thomas Geoghegan, Stanley Aronowitz.

Kate Andrias presents a new approach. And this article at Salon.

5. Create Public Jobs, about 4 to 5 million, $300 billion per year.

Senator Sanders again makes history with a May, 2018 proposal for a guaranteed job plan. See Phillip Harvey speak about a public jobs program and read his proposal. The Center for American Progress, CAP, has two proposals, "Blueprint for the 21st Century" calling for 4.2 million new jobs; this would cost the taxpayers $250 billion a year. And see this program at CAP. For info about a Universal or Guaranteed Income Plans, which I do not favor, see Peter Barnes’ book With Liberty and Dividends for All (see the books web page), and an article with James Boyce “$200 a Month for Everyone”.

6. Create Corporate Profit Sharing programs, and give tax preference status.

See the book The Citizens’ Share by Blasi, Freeman and Kruse. Only 15% of corporations have either profit sharing or ownership sharing. Both are promising methods of raising income for the 80% who are employees and vastly underpaid. Simply put, our tax policy should encourage widespread prosperity by favoring companies that share their good fortune. As I mentioned elsewhere, William Lazonick has shown that over 10 years, the top 500 companies distributed 91% of their profits either as dividends to owners or as share buybacks. Leaving virtually nothing for employee raises or research and development.

And read these articles at the Center for American Progress, one,

and at Hillary Clinton’s web page, two.

7. Create cooperative, worker-owned businesses, and give tax preference status. I suspect that mostly businesses with less than 500 employees would develop this model, but they employ nearly half the work force.

See author Alperovitz speak about his book What Then Must We Do?) and Marjorie Kelley on Broad-based Ownership Models.

8. Create National Corporate Charters, a national standard mandating worker and community member positions on the board — a Ralph Nader proposal found in his book Seventeen Solutions. The Roosevelt Institute paper on this, "Fighting Short-Termism with Worker Power -- Can Germany's Co-Determination System Fix American Corporate Governance?" takes a long look at the issue. Large corporations are the most powerful element in the American economy, and they serve only owner-shareholders. William Lazonick calls them predators and their work places "sweatshops". The quickest, and most effective, reform is an institutional one, re-designing the corporation to serve workers and community. In Lazonick's paper he begins with a litany, "In 2012, 964 companies that had 10,000 or more employees in the United States, with an average workforce of 33,542 [and employing a total of 32 million workers], were only 0.017 percent of all U.S. businesses. But these 964 companies had 9 percent of all establishments, 29 percent of employees, 31 percent of payrolls, and 36 percent of receipts." And their impact on society and economy is unparalleled. The surest and quickest way to share their profits with workers is to mandate decision making power to the workers in all 964 enterprises, or better in all enterprises with more than 500 workers, employing about 50% of all workers. Remember that "average weekly earnings of production and nonsupervisory workers" have not increased since 1964, that's a 54 year pay freeze. Corporations have not shared their profits with workers. The Commerce Dept. reports that per capita "disposable personal income" has tripled in 54 years, from $13,000 to over $39,000 (see BEA.gov, Table 2.1). I hope to write a longer paper on this corporate governance topic some day. States the Roosevelt Institute's paper, "Germans have instead adapted their system while remaining true to their values, including recognizing workers' rights and contributions and a commitment to long-term strategy and investment. . . . Germany's unique system . . . recognizes workers as corporate decision-makers, has been a key apparatus for pushing back against the pressures of shareholder ideology."

A sample from an essay by Steven Hill, author of Europe's Promise.

"Half of the supervisory board members for the largest corporations in Germany — Siemens, Bertelsmann, BMW, Daimler and many more — are elected by workers. In Sweden, one-third of the directors of their corporations are worker elected.

Imagine Wal-Mart’s board of directors having anywhere from a third to half of its directors elected directly by its workers. It’s hard to even conceive of such a notion from the American standpoint. Yet, most European nations employ some version of this as standard operating procedure. The impact has been immensely significant."

And read some charter revocation proposals here and here.

A sample from an essay by Steven Hill, author of Europe's Promise.

"Half of the supervisory board members for the largest corporations in Germany — Siemens, Bertelsmann, BMW, Daimler and many more — are elected by workers. In Sweden, one-third of the directors of their corporations are worker elected.

Imagine Wal-Mart’s board of directors having anywhere from a third to half of its directors elected directly by its workers. It’s hard to even conceive of such a notion from the American standpoint. Yet, most European nations employ some version of this as standard operating procedure. The impact has been immensely significant."

And read some charter revocation proposals here and here.

9. Mandate paid vacations for employees with at least one year of employment in the firm.

Almost all European nations mandate 20 or more paid vacation days, and some 30. The U.S. mandates zero.

10. Enable Debt Restructuring for student loans and mortgages.

11. Heal these Six major economic inefficiencies:

Health Care — We need single payer, see the OECD international comparison. The U.S. pays more than twice the OECD average per capita expense. Here's a convincing essay on the affordability of a Medicare for All plan. Essentially it is far cheaper for everyone to eliminate insurance premiums and replace them with cost-saving taxes to pay for coverage that replicates Medicare. It would not be universal coverage that includes mental health, dental, vision and hearing health, but it would duplicate the services of Medicare, but for All.

Finance — Just break up big banks? L. Randall Wray has a good paper here. Also some videos, and at INET with Marianna Mazzucato. See also this major proposal by Paul Volkert. And I refer you to # 2 above.

Military Budget, we need a reduction

Childcare expenses are prohibitively high. Here is Hillary Clinton’s plan.

Monopolies -- break them up with new standards.

13. Repair the trade deficit and create trade agreements that put labor, environmental and democratic standards in place.

Lori Wallack and Jared Bernstein wrote a recent essay on topic.

14. Create a well-funded Individual Development Account (IDA) program to increase the asset savings of the lower 50% of most Americans. Savings of poor individuals are matched, almost 1 to 2, with a government subsidy; these accounts can be used solely for education, home mortgages or business development and rarely for pension savings. Can the Poor Save? and Inclusion in the American Dream are two books describing the program. See the Center for Social Development at Washington University in St. Louis for info on the IDA program.

The parts of the entire reform are the following: about $20 billion a year for an IDA program, combined with a doubled EITC ($140 billion), a robust government jobs program (4.2 million new jobs, $250 billion), corporate profit sharing as a government incentived tax-driven norm, worker ownership-sharing also a tax-driven norm, new corporate governance rules especially for the largest corporations, stronger labor laws, a higher minimum wage, and the reduction in some basic costs such as medical care, child care, housing and education will make a radical improvement to the lower-earning 80% of America.

The parts of the entire reform are the following: about $20 billion a year for an IDA program, combined with a doubled EITC ($140 billion), a robust government jobs program (4.2 million new jobs, $250 billion), corporate profit sharing as a government incentived tax-driven norm, worker ownership-sharing also a tax-driven norm, new corporate governance rules especially for the largest corporations, stronger labor laws, a higher minimum wage, and the reduction in some basic costs such as medical care, child care, housing and education will make a radical improvement to the lower-earning 80% of America.

We must promote all of these standards and reforms globally through our trade policies with other low-labor-cost nations.

Nick Hanauer at the American Prospect has a recent article,

"Want to Expand the Economy? Tax the Rich", in the July 2018 issue. It's not enough to continue supporting the richest with very low taxes, it's time to raise their taxes to the rate of 1930 to 1980, when it averaged 78% on income over today's $1 million, about. In 1960 it was 91% on income over $3 million, and 81% on income over $1 million.

If Bernie Sanders had been elected on November 8, 2016, what would we be talking about?

We would be imaging a new way forward to a fairer economy with shared prosperity. Sanders' web page still covers 32 issues and solutions, lots of constructive thinking.

The national conversation has to continue, as ignorance is epic and dangerous. The Michael Moore movie Where Do We Invade Next? highlights the constructive social arrangements of Europe that are steps towards a shared prosperity.

Harold Myerson at the American Prospect (Feb. 23, 2017) lays out a strategy for the Democrats similar to what I've proposed here. I think main idea that politicians need to pass along to voters is that inequality has shifted dramatically, and more and more families are strapped and suffering as a result. It can be changed, but the Republican plan will make it worse, quite obviously.

An article at Inequality.org, by Bob Lord, 2/20/17, states "The experience of the bottom 50 percent in France over the same period -- 1978 to 2015 --was entirely different. They saw their real income increase by 39 percent, even though overall growth in France was only 39 percent. That’s not a clerical error. In France, the participation of the bottom 50% in the country’s growth was exactly proportional. During the same period that the income share of America’s bottom 50 percent was plummeting, the income share of the bottom 50 percent in France stayed remarkably constant, never straying more than a percentage point or so from 22 percent, with zero overall movement between 1978 and 2015."

Harold Myerson at the American Prospect (Feb. 23, 2017) lays out a strategy for the Democrats similar to what I've proposed here. I think main idea that politicians need to pass along to voters is that inequality has shifted dramatically, and more and more families are strapped and suffering as a result. It can be changed, but the Republican plan will make it worse, quite obviously.

An article at Inequality.org, by Bob Lord, 2/20/17, states "The experience of the bottom 50 percent in France over the same period -- 1978 to 2015 --was entirely different. They saw their real income increase by 39 percent, even though overall growth in France was only 39 percent. That’s not a clerical error. In France, the participation of the bottom 50% in the country’s growth was exactly proportional. During the same period that the income share of America’s bottom 50 percent was plummeting, the income share of the bottom 50 percent in France stayed remarkably constant, never straying more than a percentage point or so from 22 percent, with zero overall movement between 1978 and 2015."

An article by Piketty, Saez, and Guzman states, "While the bottom 50 percent of incomes were 11 percent lower in France than in the United States in 1980, they are now 16 percent higher."

Today the lower-earning 50% in France has a higher standard of living -- with incomes 16% higher -- than the bottom 50% in the U.S., despite the fact that the per capita income is $36,205 in France and $56,115 in the U.S. according to the World Bank.

The problem is quite obvious, isn't it.

___________________________________________________________________

Today the lower-earning 50% in France has a higher standard of living -- with incomes 16% higher -- than the bottom 50% in the U.S., despite the fact that the per capita income is $36,205 in France and $56,115 in the U.S. according to the World Bank.

The problem is quite obvious, isn't it.

___________________________________________________________________

About Inequality

This may be redundant to anyone who's read my blog. But it's still worth your attention. It's shocking, no less. See the last paragraph.

We have abundant prosperity in the U.S. but it is not shared.

A new vision must emerge to share this abundance with all. Of the total annual income of the U.S. economy, 22% goes to the top-earning one percent, while the lower-earning fifty-five percent earn a collective 16%. The best report on this comes from this site, The Washington Center for Equitable Growth. I quote it's report below, but as an example it states that the standard of living in France for the lower 50% is higher than the standard in the U.S. for the lower 50%, as their income is 16% higher (I mentioned already, yes.)

The Bureau of Economic Analysis, Department of Commerce, reports that the annual post-tax income of each citizen, all 325 million citizens, is $43,075 in Q2 of 2016. This works out to an “average” income for all four person families of $172,300 per year. Yet half of these families have incomes of less than $64,700 after paying all taxes, and $63,741 is the national median cost of living for this 4 person family according to the Economic Policy Institute. Therefore, about half of all such families have less income and are struggling to achieve a modest lifestyle. Half of the U.S. has no money for frills of savings. They are working paycheck to paycheck. (I cover most of this with links to sources in the previous essay at this blog.)

30% live in poverty, unable to "achieve a safe and decent standard of living".

The author of the U.S. Census report Supplemental Poverty Measure states (on page 23 of linked report) that 140% of the poverty level is the accurate poverty level below which people “are unable to meet their basic needs”, and 30% of the U.S. population, about 95 million in 2016, fall into the category.

Therefore, 50% of U.S. citizens are struggling and 30% are living in poverty. Yet we have abundant prosperity, over $100,000 of income for all households says the report from the Congressional Budget Office. Over $721,000 of savings per household, states the Federal Reserve Flow of Funds report, page 2.

A new vision must emerge to share this abundance with all. Of the total annual income of the U.S. economy, 22% goes to the top-earning one percent, while the lower-earning fifty-five percent earn a collective 16%. The best report on this comes from this site, The Washington Center for Equitable Growth. I quote it's report below, but as an example it states that the standard of living in France for the lower 50% is higher than the standard in the U.S. for the lower 50%, as their income is 16% higher (I mentioned already, yes.)

The Bureau of Economic Analysis, Department of Commerce, reports that the annual post-tax income of each citizen, all 325 million citizens, is $43,075 in Q2 of 2016. This works out to an “average” income for all four person families of $172,300 per year. Yet half of these families have incomes of less than $64,700 after paying all taxes, and $63,741 is the national median cost of living for this 4 person family according to the Economic Policy Institute. Therefore, about half of all such families have less income and are struggling to achieve a modest lifestyle. Half of the U.S. has no money for frills of savings. They are working paycheck to paycheck. (I cover most of this with links to sources in the previous essay at this blog.)

30% live in poverty, unable to "achieve a safe and decent standard of living".

The author of the U.S. Census report Supplemental Poverty Measure states (on page 23 of linked report) that 140% of the poverty level is the accurate poverty level below which people “are unable to meet their basic needs”, and 30% of the U.S. population, about 95 million in 2016, fall into the category.

From the report:

"The overall poverty rate using the updated modified family budget thresholds was 30.0 percent, about 13.9 percentage points higher than the 16.1 percent SPM rate. . . .

approximately 140 percent of the SPM threshold, rather than 200 percent, may be characterized as not able to meet their basic needs and achieve a safe and decent standard of living, or as families with ‘low income’.

"The overall poverty rate using the updated modified family budget thresholds was 30.0 percent, about 13.9 percentage points higher than the 16.1 percent SPM rate. . . .

approximately 140 percent of the SPM threshold, rather than 200 percent, may be characterized as not able to meet their basic needs and achieve a safe and decent standard of living, or as families with ‘low income’.

Yet half of U.S. households own less than $85,000, the lower-saving 50% of households own 1.1% of the nation’s total household savings. And 35% of households own less than $10,000, see here.

The United Nations ranks nations according to a Human Development Index. The U.S. falls into 8th place before the reality of inequality is taken into consideration. The adjusted inequality status places the U.S. in 28th position, and its neighbors were Italy and Greece, in one year, and Poland and Cypress in another.

Stanford University's Center of Poverty and Inequality published a report in late 2016 stating on page 5: "the U.S. has the lowest overall ranking among our 10 well-off countries, a result that arises in part because it brings up the rear of the pack in three of the six domains covered here (safety net, income inequality, wealth inequality). Even when the comparison set is expanded to include the less well-off countries, the U.S. still ranks a dismal 18th (out of 21 countries), with only Spain, Estonia, and Greece scoring worse (see Table 4).

This inequality and poor results to share our prosperity is ignored in political discussion, and solutions to it are off that table. But clearly we have the resources and the available programs, we just have failed to reach a national awareness and consensus on how to remedy the condition.

The Corporation

The 14 Solutions I propose are radical because they restructure our major institution, the corporation. A U.S. Census report states that 50% of non-supervisory employees, about 60 million workers, work in firms with more than 500 workers, and 66% work in firms with more than 100 workers. The corporation is where America works, and is underpaid. Professor William Lazonick reports that 91% of corporate profits among the S&P 500 corporations, between 2001 and 2011, an amount of $4.44 trillion, went to shareholder dividends and stock buybacks, leaving very little for wage increases or research and development. The author concludes this will be catastrophic to the economy if it continues, and corporate reform must be included in a broader appreciation of our problems and solutions.

In the previous essay at this blog, I showed the EPI.org report "What Should Be Your Pay?" There you enter a yearly salary and discover that it would be about $20,000 higher if wages and salary growth had tracked the growth of productivity, as it had for the 30 years 1947 to 1977. The previous essay, at this blog, deals extensively with literature about this loss of income for most, 80%, of U.S. workers. Maybe you are one of those workers, or live in one of those families?

In the previous essay at this blog, I showed the EPI.org report "What Should Be Your Pay?" There you enter a yearly salary and discover that it would be about $20,000 higher if wages and salary growth had tracked the growth of productivity, as it had for the 30 years 1947 to 1977. The previous essay, at this blog, deals extensively with literature about this loss of income for most, 80%, of U.S. workers. Maybe you are one of those workers, or live in one of those families?

The National Jobs for All Coalition reports in its monthly employment report that about 12% of U.S. workers are looking for a full-time job, and another 12% are working full-time and year-round for wages less than the poverty level for a four person family. Since the per capita income in America is $43,075 for all 325 million citizens, it is grossly unequal that 24% of workers are earning less than $25,000. In fact, the Social Security Administration reports that 45% of workers, or 71 million, earn less than $25,000 annually. Together their collective income comes to less than 6 percent of the total annual national income states the report from the Social Security Administration.

Raising wage income is the primary theme and concern of the Economic Policy Institute, see their extensive report “Raising America’s Pay”. One of the institute’s reports states, “Between 1979 and 2013, the top 1 percent’s share of income doubled nationally, increasing from 10 percent to 20.1 percent.” And,

“The average inflation-adjusted income of the bottom 99 percent of families grew by 18.9 percent between 1979 and 2007. Over the same period, the average income of the top 1 percent of families grew by 200.5 percent [or tripled]. This lopsided income growth means that the top 1 percent of families captured 53.9 percent of all income growth over the period.” (see “Income Inequality in the U.S. by state, metropolitan area, and county”).

Regurgitating details about inequality can take us only so far. We need a comprehensive view of our needs and possible restructuring.

Since writing and posting this essay I've read Lawrence Mitchell's essays on Financialism. I feel he has captured the germ of the problem, the hoarding of the economic surplus by a wealthy minority, and such action continually pumps-up the value of financial assets, corrupting the motivation for actual productive use of the surplus. Eventually the system will collapse by destroying the host.

If you owned a successful corporation making abundant surplus where would you invest, in your company or in the financial market? You’d be crazy if you invested in your company. This dynamic parallels the research of William Lazonick who showed, 2003 to 2013, that 450 of the S&P companies spent 91% of profits on dividends and stock buybacks, not on R & D or employee raises.

See my last essay.

The economy adds $41 trillion in savings 2009 to 2016, an increase nominally of 84% Also, since 2009, private household net worth has grown by 64% adjusting for inflation, from $48.9 trillion to $90.2 trillion — Flow of Funds, page 2 — at the same time the economy had its worst performance in 75 years -- 9 million lost their jobs permanently, another 6 million lost their homes through foreclosure, the median household lost 40% of its life savings.

By my calculation the top one percent increased their average savings from $19 million in 2009 to $33 trillion in 2016.

That covers wealth, and the Washington Center of Equitable Growth describes income: From 1980 to 2014, average national income per adult grew by 61 percent in the United States, yet the average pre-tax income of the bottom 50 percent of individual income earners stagnated [no growth] at about $16,000 per adult after adjusting for inflation.5 In contrast, income skyrocketed at the top of the income distribution, rising 121 percent for the top 10 percent, 205 percent for the top 1 percent, and 636 percent for the top 0.001 percent. (See Figures 1 and 2.)

How are these two trends possible -- the immense growth in savings and income for the wealthiest while the typical household loses 40% of its life savings, incomes drop to 1996 levels, and jobs become more precarious, and housing less affordable? Why are so many citizens ignorant of these dual trends? Has the news media in this country failed? Real trillion dollars of gains went to a minority, while the majority suffered. Is this truly a democracy?

In eight years, 2008 to 2016, GDP increased 10.5%, and real disposable income was up 12.3% (BEA.gov Table 2.1) -- but total savings increased a huge $41 trillion, up 64%, to $90 trillion. The national debt increased by $10 trillion to $20 trillion. And politicians claim it's impossible to pay off the debt, government programs must be slashed.

Since writing and posting this essay I've read Lawrence Mitchell's essays on Financialism. I feel he has captured the germ of the problem, the hoarding of the economic surplus by a wealthy minority, and such action continually pumps-up the value of financial assets, corrupting the motivation for actual productive use of the surplus. Eventually the system will collapse by destroying the host.

If you owned a successful corporation making abundant surplus where would you invest, in your company or in the financial market? You’d be crazy if you invested in your company. This dynamic parallels the research of William Lazonick who showed, 2003 to 2013, that 450 of the S&P companies spent 91% of profits on dividends and stock buybacks, not on R & D or employee raises.

See my last essay.

The economy adds $41 trillion in savings 2009 to 2016, an increase nominally of 84% Also, since 2009, private household net worth has grown by 64% adjusting for inflation, from $48.9 trillion to $90.2 trillion — Flow of Funds, page 2 — at the same time the economy had its worst performance in 75 years -- 9 million lost their jobs permanently, another 6 million lost their homes through foreclosure, the median household lost 40% of its life savings.

By my calculation the top one percent increased their average savings from $19 million in 2009 to $33 trillion in 2016.

That covers wealth, and the Washington Center of Equitable Growth describes income: From 1980 to 2014, average national income per adult grew by 61 percent in the United States, yet the average pre-tax income of the bottom 50 percent of individual income earners stagnated [no growth] at about $16,000 per adult after adjusting for inflation.5 In contrast, income skyrocketed at the top of the income distribution, rising 121 percent for the top 10 percent, 205 percent for the top 1 percent, and 636 percent for the top 0.001 percent. (See Figures 1 and 2.)

How are these two trends possible -- the immense growth in savings and income for the wealthiest while the typical household loses 40% of its life savings, incomes drop to 1996 levels, and jobs become more precarious, and housing less affordable? Why are so many citizens ignorant of these dual trends? Has the news media in this country failed? Real trillion dollars of gains went to a minority, while the majority suffered. Is this truly a democracy?

In eight years, 2008 to 2016, GDP increased 10.5%, and real disposable income was up 12.3% (BEA.gov Table 2.1) -- but total savings increased a huge $41 trillion, up 64%, to $90 trillion. The national debt increased by $10 trillion to $20 trillion. And politicians claim it's impossible to pay off the debt, government programs must be slashed.