Comparing the 1950s and Today --

Economics and Taxation

We remember the 1950s fondly because of 1957 Chevys, Elvis, President Eisenhower and sports stars like Willie Mays, Johnny Unitas, Rocky Marciano, Bob Cousy, Althea Gibson, Pancho Gonzalez, jockey Willie Shoemaker and Leo Nomellini who was a 6 time All NFL defensive and offensive tackle for the San Francisco Forty-Niners.

Also we remember that mothers could be “homemakers” instead of employees at work, and buying a family home cost the equivalent of 2 years’ income, not today’s 3.5 years’ income with two earners in the family. Between 1947 and 1979 all income groups doubled their incomes, in inflation adjusted dollars. Times were good, incomes were rising for most but not all Americans.

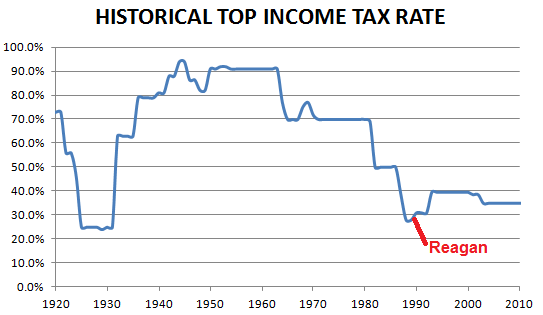

Our economy was much different, as was our federal taxation policy. In the 1950s society was comfortable with a top marginal income tax rate of 90% on all income above today’s $1.6 million. After $1.6 million, the next dollar was worth just ten cents to the earner, and 90 cents to the federal government and society. For 20 years, 1943 to 1963, the top rate averaged over 90%.

Today the average pre-tax income of the top 1% of taxpayers, some 1.6 million filers, is $1.6 million. Their total combined income exceeds $2.2 trillion, and amounted to 19% of all income in 2014. If today’s annual millionaires had to pay 1950’s tax rates, that last $600,000 of income would be worth not much more than $60,000 to them and $540,000 to the U.S. Treasury. The 90 percent rate was regarded as nothing out of the norm.

Researchers find that in the ‘50s the effective tax rate for the one percent was 49% of all income. Today’s effective overall rate (state and local taxes included with federal) in 2014 is 33%. Also corporations paid on average 27% of all federal taxes instead of today’s 10%, the effective corporate tax rate was 40% not 27%. The ratio of CEO to worker compensation was an amazing 20 to 1, not today’s frightening 231 to 1. The income share going to the top 1% of incomes was 10% not today’s 20%. Union membership would range in the low 30 percent, not today’s 6.6% in private enterprise. Wages and employment were stable and growing.

One very stark contrast with the 1950s is the story of America’s top-earning CEO in 1950, Charles Wilson, head of General Motors, the largest automaker in the world. One writer reports,

“GM’s president “Engine Charlie” E. Wilson told Congress in 1953, ‘What’s good for America is good for General Motors, and vice versa.’ He took home $586,100 a year when the minimum wage was $0.75 an hour and gasoline was $0.27 a gallon.

During this time 80 percent of the world’s auto production and assembly was centered in Detroit. Back then GM was the world's largest corporation and had 46 percent of the American auto market. At its peak, the company employed more than 600,000 Americans.”

Adjusting for inflation Wilson’s income would be today $5.8 million. Today, a CEO earning “just” $5.8 million is less than mediocre. William Lazonic reports, “In 2012 the 500 highest-paid executives named in proxy statements of U.S. public companies received, on average, $30.3 million each; 42% of their compensation came from stock options and 41% from stock awards.” What’s more remarkable about Wilson’s income is comparing the pre-tax, $5.8 million, with the post-tax income, $1.6 million. He paid an effective tax rate of 73%. Contrast that with today’s effective tax rate for the top one percent at 33%.

About 1.6 million tax filers reported in 2014 a pre-tax income of $1.6 million, according to the Congressional Joint Committee on Taxation (CJCT), page 29. Wilson’s post-tax income was $1.6 million, and his salary was the highest in America. Now there are 1.6 million with that same amount, $1.6 million in pre-tax income, and their post-tax income is around $1.1 million. (Again, in 1950 1 taxpayer had a post-tax income of $1.6 million, today 1.6 million men or women taxpayers have a pre-tax income of $1.6 million.) The American economy is much more productive than the 1950s, but producing a million more annual millionaire-incomes is not an accurate gauge of its growth. Instead it indicates the growth of the millionaire class to the expense of all other earning groups.

The pre-tax income share for 0.9% of tax filers was 18.9% in 2014, according to the CJCT; one percent earned more than 55% who earned a 16.2% share. One percent earned 19%, five percent earned 34%, 20 percent earned 61%, and that leaves 39% for the lower eighty percent of tax filers to share among themselves. The group between the 50th and 80th percentiles earned 23%, and the lower 55 percent earned 16% — pre-tax income.

See this revealing chart comparing income growth by income sectors 1947 to 1979, 1979 to 2007, and 2007 to 2013. And see this report from the CBPP with the "after-tax income" graph below --

Post-tax income reflects government taxes and transfers which assist low-income workers, their children, the poor, the disabled, and elderly. The poverty rate in 2014 was cut from 31% of the U.S. population (pre-transfer) to 15.3% (post-transfer) according to the Supplemental Poverty Measure. Elderly above 65 years of age saw their poverty rate decreased from 50.0% to 14.4% through Social Security transfers. In all, about 6% of all income is transferred by Social Security, and another 8% in all the assistance programs. Researchers at Columbia University state that poverty has been reduced since 1967 from 26% to 16% in 2012 and now to 15.3% in 2014.

Today the ratio between the average income in the lower-earning 55 percent to the average in top 1 percent is 1 to 69. The average income of a tax filer in the lower 55 percent, with income below $50,000, on average, is 69 times lower than the average of the top 1 percent, with income above $500,000. An easier way to remember this is to say that total combined income of two workers after 35 year careers is equal to one year’s income of one top-earning “one percenter”. (Two times 35 years is 70 years, and the ratio between the average income of the lower-earning 55% of U.S. workers to the average top one percent income is 1 to 69.)

Is the lifetime work-contribution of two low-earning workers equal to one year of work from a top-earner? How do you measure? What would Charlie the Engine Wilson be thinking? “If it’s good for GM it’s good for America.” Today’s CEO will have another response, “We deserve it.” I doubt there is a convincing argument that justifies the one percent income group tripling its income in 30 years while the large group, of nonsupervisory workers comprising 80% of all workers, sees their annual income since 1962 decreasing by 5% in 54 years. And that’s what the studies and government agencies report. One study states, “Between 1979 and 2007, the top 1 percent took home well over half (53.9 percent) of the total increase in U.S. income. Over this period, the average income of the bottom 99 percent of U.S. taxpayers grew by 18.9 percent. Simultaneously, the average income of the top 1 percent grew over 10 times as much—by 200.5 percent.”

In 2016 we are are in a different world. The Bureau of Economic Analysis, Dept. of Commerce, shows that 1955 per capita “Disposable Personal Income” was $11,172, while in 2015 it was $38,050, nearly 4 times more in inflation adjusted dollars. On the positive side “market” or pre-tax poverty was reduced in 2012 by government transfers from 27.8% to 16.0%, a drop of 12.7%, while in 1967, the first year of measurement, the poverty rate moved from 27.0% to 25.8%, a drop of 1.2%. But negatively, jobs for the coming generation will pay less. Of the fastest growing 15 occupations, 11 pay between $18,410 and $31,200 a year. And labor union participation is a shadow of its former self; only 6.6% of private enterprise workers belong to a union instead of mid 30 percent in the 1950s. Oddly Canada to the north still has a labor union participation rate of 30 percent. The 1935 National Labor Relations Act has been stripped of its power by judicial amendment, and the chiefs of the unions have long called for scrapping the NLRA.

In 1956, at age 24, Floyd Patterson became the undisputed heavyweight champion of the world, the youngest boxer to achieve that title. In 1959 he was knocked out by Ingemar Johansen in their first fight. He came back winning the second. But he lost their third and last fight. He said, "They said I was the fighter who got knocked down the most, but I also got up the most.” We should be so lucky and plucky that some day we all might say the same. Down, but not out.

As an after-thought I thought it useful to show the income distribution page from the Congressional Joint Committee on Taxation, Overview, 2015, page 28:

3 comments:

Great article! Just what I was looking for.

Herpes Illness can be cured naturally, I was a former sufferer but I succeeded to get rid of it with natural remedies. I highly recommend Dr John to every ladies and male having issues about Herpes Cure I highly recommend. His Services includes Love spell (Get Ex back), Lottery spell, Promotion spell, Financial spell, viasiness Boom Spell, Voodoo etc he also help get the following Diseases cured Hiv/aid, Arthritis, -Fibromyalgia, -Osteoarthritis, Asthma

Borreliosis (Lyme disease), ALS Abdominal infection, Diabetes, Epilepsy, Lupus eMinimizetc DM Dr John if you are interested WhatsApp +2348131983338 Email (drjohnspelllord @ gmail . com) Thanks

Great reading yyour post

Post a Comment