Congressman Tom McClintock was elected in 2012 running against Jack Uppal. McClintock spent $5.69 for each vote he got, Uppal spent 41 cents. McClintock won by 61% to 39% margin. See below for sources.

Questions for McClintock

I have several questions here, but this essay is more a background paper on Obamacare and the Ryan Budget. I think if one asks the Representative a controversial question one should have a passion and a depth of knowledge to argue one's point of view strongly. So, this is not a list of questions. I document facts and most questions are implicit, and I do place some questions of my own. None deal with the environment or local issues and other problems.

The nation faces three choice: either we raise taxes on very high income and wealth households, who have increased their collective wealth by $15 trillion over the past five years, and apply the revenue to create full employment policies, or we muddle along slowly with "centrist" Obama austerity proposals that leave 27 million Americans unemployed and underemployed and another 50 million with very low incomes, or we injure the poorest Americans, in the pretext of balancing the budget, by cutting the federal programs that serve them, which in essence is the Ryan proposal.

I have added a second section, a more detailed examination of Obamacare or the ACA.

The nation faces three choice: either we raise taxes on very high income and wealth households, who have increased their collective wealth by $15 trillion over the past five years, and apply the revenue to create full employment policies, or we muddle along slowly with "centrist" Obama austerity proposals that leave 27 million Americans unemployed and underemployed and another 50 million with very low incomes, or we injure the poorest Americans, in the pretext of balancing the budget, by cutting the federal programs that serve them, which in essence is the Ryan proposal.

I have added a second section, a more detailed examination of Obamacare or the ACA.

1. Obamacare -- See my long version below towards the end of this essay for some questions to ask.

Which of the following improvements that Obamacare will make to our medical system do you, Representative McClintock, object to?

Do you object that

1) it becomes illegal for health insurance companies to arbitrarily cancel your health insurance just because you get sick.

2) Do you object that of the 48 million Americans, one in every six, who go without health insurance, maybe half will now have insurance?

3) it holds companies accountable for rate increases (rates went up 80% in last 10 years)

4) it requires companies to cover people with pre-existing conditions

5) it protects your choice of doctors

6) it provides free preventive care

7) it covers young adults under 26

8) it limits administrative expenses to 15% of premium revenue, costs such as salaries, sales and advertising, whereas Medicare reports administrative overhead is only 1.4%.

9) it ends lifetime and yearly dollar limits on “essential health benefits” coverage

and it requires all plans in the Marketplace to offer “essential health benefits”. See here

This is the web page for info on the first 7 points--

I don’t think he’ll object to any of these improvements. But he will maintain that Obamacare is a disaster threatening the nation .

$16,104 per year is normal for medical costs for a 4 person family.

One quarter of the family budget goes to medical insurance and care. See the Family Budget Calculator at epi.org, here, and find the basic needs budget for Topeka, Kansas, the area where the costs of living are in the middle, the median, where half of the U.S. pays more and half pay less to provide. You'll see that the annual cost for medical care and insurance, for a four person family, is 12 times the monthly $1,342, or $16,104 per year. This is 25% of the family's budget. And check the other facts about medical costs at the bottom of this essay.

An Expert Interviewed

Listen to this expert, Tom Moore, with 30 years experience, explain the "mess" of why health costs keep rising, on the Jack Rasmus radio show. And "googling" the statement "why health care costs keep rising" will bring articles that explain why, see here for example.

$16,104 per year is normal for medical costs for a 4 person family.

One quarter of the family budget goes to medical insurance and care. See the Family Budget Calculator at epi.org, here, and find the basic needs budget for Topeka, Kansas, the area where the costs of living are in the middle, the median, where half of the U.S. pays more and half pay less to provide. You'll see that the annual cost for medical care and insurance, for a four person family, is 12 times the monthly $1,342, or $16,104 per year. This is 25% of the family's budget. And check the other facts about medical costs at the bottom of this essay.

An Expert Interviewed

Listen to this expert, Tom Moore, with 30 years experience, explain the "mess" of why health costs keep rising, on the Jack Rasmus radio show. And "googling" the statement "why health care costs keep rising" will bring articles that explain why, see here for example.

________________________________________

My very basic facts list:

Half of U.S. households own 1.1% of all private wealth (see here).Half of U.S. workers in 2012 earned in wages 6% of all personal income (see here for wage income and here -- BEA.gov for personal income and outlays or divide $750 billion by $14 trillion). The lower-earning half of U.S. workers earn 15 times less than the higher-earning half, on average $10,000 to $150,000 -- (see the link to the Social Security Administration report again).

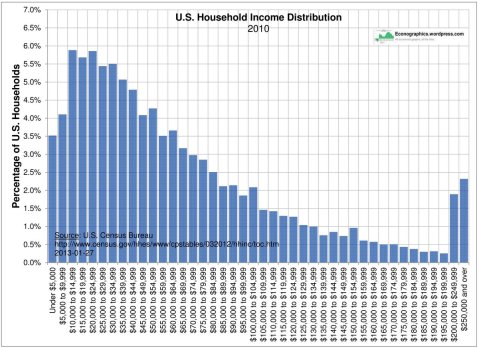

Average household income was $104,163 in 2011 according to this source, or it was $75,100 according to this report, while median household income was $50,502, see here.

$51,749 is the 2013 economic output or GDP per capita, see here, and $44,164 is the personal income per capita, and $36,943 is the 2013 per capita after-tax personal income, see here. Gar Alperovitz, a professor at University of Maryland, states that, "the current American economy today produces roughly $200,000 for every family of four right now [$50,000 per capita]. We don’t have an economic problem, we have a political problem managing the wealthiest economy in the world. If we were at full-employment, it’d be closer to $250,000. Or—I then say—$100,000/year with a 20-hour week."

(See the end of this long interview for the source.)

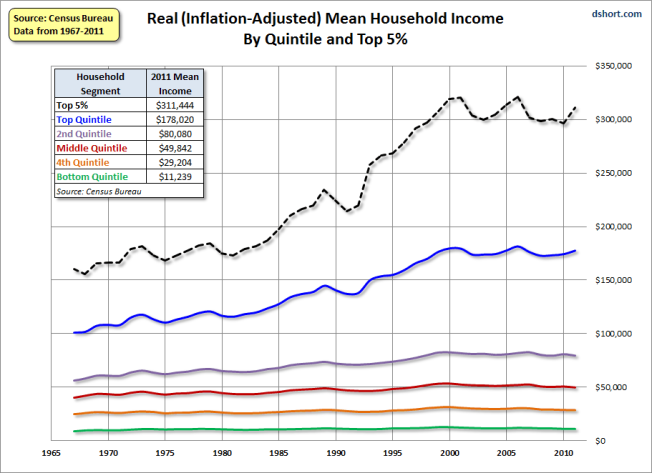

The top 1% took in 86.3% of all economic growth over the 32 year period 1979 to 2011, increasing their income by 128.9% while the lower-earning 99% increased its income by 2.3% -- see here.

The income of the top one percent was 24 times greater than the average for the lower 99%, see here and here.

The largest gap since records began in 1967 between the incomes of the 20th percentile and the 95th was recorded last year. See here, point 8.

One in eight workers are unemployed (18 million).

(See the next essay at this blog for all sources about unemployment.)

One in five are unemployed or underemployed (29 million).

Three out of ten workers (47 million) are either out of work, underemployed, or "working full-time, year-round, yet earned less than the official poverty level for a family of four. In 2012" according to this source. 47% of all workers earn less than $25,000 per year, and their average income is below $10,000.

$23,550 is the poverty level for a family of four. The EPI estimates that $63,364 per year is the basic income needed for a family of four, the median family's needs, see here and look for bullet point one. To the 30% already mentioned, add 12% who work part-time voluntarily to reach 42%. Then add 5% who have part-year work to reach 47% of all workers earning annually less than $25,000. See here. Combined, their income is around $745 billion, less than 6% of all personal income, and total personal income, according to the BEA, is now above $14 trillion, and the Congressional Joint Committee on Taxation reports total income (see page 28) at $11.468 trillion in 2012. That's $74,000 for the average worker income including the unemployed, $79,000 not including the unemployed, nearly 3 times more than the median worker's income of $27,519.

We are a very wealthy nation, but the wealth is very unevenly distributed. In 2010 the Federal Reserve reported (page 17) that the mean average family savings was $498,800. Since 2008 the mean average has risen to $650,000 per family. In the past five years the top-earning five percent, or 6 million families, have increased their wealth by $2.5 million on average while the median household's income has dropped by 8% to levels of 1996. The wealth increase was all due to the increase in financial assets' values. The income decrease was all due to the financial system self-destructing. Please note the unfairness of this outcome.

We can afford higher taxes on the extremely wealthy, such as an 80% income tax rate for incomes over $400,000 (see below), and to use that revenue to create employment, such as envisioned by the Progressive Caucus' The Budget for All. And federally subsidized jobs have increased employment according to this CBPP report by LaDonna Pavetti, and this program spent $5,000 in federal funds for every job created, and it should be expanded.

_______________________________________

2. The Ryan Budget is a fraud

This CPBB paper explains the Ryan Budget income tax cuts.

This CPBB paper explains the federal programs that will be cut.

This paper by Andrew Fieldhouse explains and has links to important reports.

This Demos paper is a full proposal, a blueprint for progressive change.

Make a question from the following:

This CPBB paper explains the federal programs that will be cut.

This paper by Andrew Fieldhouse explains and has links to important reports.

This Demos paper is a full proposal, a blueprint for progressive change.

Make a question from the following:

The Ryan budget is a major tax cut for the wealthy. It reduces the top income tax rate for income over $400,000 from 43% to 25%. This one percent receives 21.9% of all national income. In contrast, the collective income for 60% of households is 21.4% (see here). That means the income for the one million plus households in the top 1% is each year 60 times greater than the average income for 70 million households, or 192 million U.S. citizens. The main feature of the Ryan budget is this income tax cut for the wealthiest. As it cuts total tax revenues to a 1950 era level (when the top 1% paid a 91% income tax rate, not a 43% rate or a 25% rate, and when the top 1% took in "only" 10% of all income not today's 21.9%, see here -- second graph), it reduces government programs serving the poorest Americans. But since it still doesn’t balance, it additionally proposes to cut out certain tax deductions or tax preferences to balance out. But it refuses to state which tax deductions will be touched. It sounds like a fraud and it has been widely criticized, and it's essentially a give-away to the richest who "own" our government.

This Tax Policy Center report claims that those with incomes over $1 million will increase their after-tax income by 12.5%, while those with income between $40,000 and $50,000 will increase their income by 1.3%.

This Tax Policy Center report claims that those with incomes over $1 million will increase their after-tax income by 12.5%, while those with income between $40,000 and $50,000 will increase their income by 1.3%.

The federal budget -- exclusive of Medicare and Social Security -- is seriously under-taxed. For every $100 the federal budget spendson programs exclusive of Social Security, it raises $62 in taxes

and borrows $38. (See OMB budget table, page 25) Or you can

look at the Wikipedia article on "The Economy of the U.S." and find the two charts on federal revenues and expenditures, here. Much of my story is found in the charts at the Wikipedia site.

and borrows $38. (See OMB budget table, page 25) Or you can

look at the Wikipedia article on "The Economy of the U.S." and find the two charts on federal revenues and expenditures, here. Much of my story is found in the charts at the Wikipedia site.

I took much of my information from this EPI report by Andrew Fieldhouse, The Ryan Budget versus the Budget for All . And see his other excellent reports, here and here.

A tax give-away to the wealthiest

A tax give-away to the wealthiest

The highest earning 5% of households, with an average income of $660,000 per year, took in 36.2% of all personal income in 2013, and would receive 71% of all tax benefits from the Ryan plan.

Households that earned less than $75,000, the lower-earning 80%, received 39.8% of all income and would receive 6% of all of Ryan's tax benefits. -- from the Tax Policy Center of the Brookings Institute/Urban Institute, referenced here. on page 11.

So 71% of households receive 6% of all benefits while 5% receive 71% of benefits. See this report from Citizens for Tax Justice for a comprehensive look at Who Pays Taxes in America?

Households that earned less than $75,000, the lower-earning 80%, received 39.8% of all income and would receive 6% of all of Ryan's tax benefits. -- from the Tax Policy Center of the Brookings Institute/Urban Institute, referenced here. on page 11.

So 71% of households receive 6% of all benefits while 5% receive 71% of benefits. See this report from Citizens for Tax Justice for a comprehensive look at Who Pays Taxes in America?

Households with incomes greater than $1 million would receive $330,000 in tax breaks, and households with incomes between $50,000 and $75,000 would receive between $2,000 and $3,000. The Ryan Budget cuts federal revenues by cutting income taxes and corporate taxes. In turn it then cuts government programs to balance the budget; it plans to reduce by half all non-defense discretionary spending.

Robert Greenstein, the director of the Center for Budget and Policy Priorities, says,

“House Budget Committee Chairman Paul Ryan’s new budget plan specifies a long-term spending path under which, by 2050, most of the federal government aside from Social Security, health care, and defense would cease to exist, according to figures in a Congressional Budget Office analysis released today.” What would be defunded and would disappear include, “everything from veterans’ programs to medical and scientific research, highways, education, nearly all programs for low-income families and individuals other than Medicaid, national parks, border patrols, protection of food safety and the water supply, law enforcement, and the like.”

The wealthiest 1% of households nearly tripled their income since 1980, doubled their share of all post-tax and post-transfer income from 8% to 17% between 1979 and 2007 (see the CBO report, page xi), and takes in

more income yearly than the collective income of 60% of households (21.9% vs. 21.4%). Read the NYTimes article explaining that the top-earning 10% of households now earns more than 50% of all income.

The Ryan Budget cancels out Obamacare.

It cuts non-defence discretionary programs down to 2.1% of GDP, about half their 50 year historical level of 3.9%.

About 66% of the cuts adversely affect programs that serve the poorest Americans -- It will reduce Medicaid that serves 60 million Americans by half by 2022. Medicaid expense is about half the expense of all federal assistance programs. Other programs such as Suplemental Security Income, Food Stamps, child nutrition, school lunches, Pell Grant educational grants supporting students from low income families, housing support, unemployment compensation, veterans services, federal pensions would be cut. We are a wealthy nation, on average each of the 120 million households owns $646,000 in savings, according to the Federal Reserve Bank report called Flow of Funds, Dec. 2013.

Their plan would increase unemployment and slow GDP growth according to the

Economic Policy Institute and the Tax Policy Center.

Ryan says that the safety net is a “hammock that lulls able-bodied people into a life of dependency and complacency.” The question for McClintock -- it’s here in these facts.

The wealthy receive massive tax cuts, the poor receive program cuts, the federal deficit is not reduced, and unemployment and the economy suffer -- this is the Ryan Budget.

The wealthy receive massive tax cuts, the poor receive program cuts, the federal deficit is not reduced, and unemployment and the economy suffer -- this is the Ryan Budget.

3. Two-thirds of the program cuts come from programs serving the poor. It would privatize Medicare by sending inadequate vouchers to seniors and raise eligibility age to 67, and it would cap Medicaid expenses and transfer the expense for the states to pick up. See this article from the Center for Budget and Policy Priorities.

4. Inequality -- Is inequality a problem, and what can be done about it?

half of all workers, 77 million workers, receive just 6% of all personal income

half of all households receive just 17% of all personal income

half of all households own just 1.1% of all wealth

Our economy is badly out of balance, poverty is increasing. About 30% of Americans would be poor without government transfer programs. This is a nation with over $51,000 of economic activity per human, over $41,000 of income per human, over $84,000 of income per worker on average -- and the market income of 30% of the nation is below poverty before government steps in with transfers and reduces poverty to 16.0%.

In the past 5 years the nation’s total wealth has expanded from $57 trillion to $77 trillion, according to Federal Reserve Bank’s Flow of Funds report. A $20 trillion increase evenly distributed among all households would increase the savings of each U.S. household by $170,000. On average every household owns $646,000 in savings, we are very wealthy. But half of all households own less than $11,000 because half own only 1.1% of all savings. Of the $20 trillion gain in wealth, 75% has gone to the wealthiest 5% who own 75% of all financial assets. On average each of the 6 million households have increased their savings by $2,500,000 over the past five years, during which time the income for 90% of households has declined, and the median household income has dropped by 7%, froom $55,000 to $51,000. Today’s median household level income is equal to the median income of 1996. The wealth of the median household is down to the level of 1969 according to Edward Wolff, a scholar of wealth accumulation. The lower earning and lower saving majority, perhaps 90% of the population, is tracking downward while wealth and income are expanding for the benefit of the richest --- $20 trillion in five years going only to those who own finanacial assets.

5% of households consume as much as 80%

A question to Mr. McClintock, or to any Republican, might address this glaring fact: 5% of households consume about the same dollar amount as 80% of households. There should be an exclamation mark. Where's the exclamation mark?

This graph comes from Too Much, Feb. 10, 2014. In 20 years the top-consuming 5% has jumped their consumption by 17%, or $2.4 trillion. Find your income percentile here at this source.

The next chart comes from a New York Times article on health care (Source here) The "pie" may be enlarging, but the "typical household" income is not. The next two graphs show this.

The median household income has increased by $9,200 or 22%, from $41,668 to $50,865 from 1967 to 2010 (see here). By my calculation, real disposable per capita personal income increased by $16,847, 1967 to 2010. So the typical household should have witnessed an income gain of $43,466, not $9,200. So the median income grew by one fifth the rate of the economic growth. And Robert Reich is correct when he states the median income could be $92,000 per year. The top 5% saw their income increase by $131,000 or 79%. This source shows that Real GDP per capita (inflation adjusted) increased by 118%, 1967 to 2010, from nearly $22,000 to nearly $48,000. The St. Louis Fed's graph confirms this:

Somehow the typical family saw only a fifth of the gain. Why is that? Is this the wonder of the free market? As I stated above, 86% of all growth went to 1% of households, 1979 to 2011.

Is this too complicated? Here's a graph that simplifies (from this source):

Here is an excellent article by Barry Ritholtz showing that 54% of Republicans and 75% of Democrats believe inequality is a serious problem.

Sources for Income and Taxation Information

Here are four sites with easy to read charts showing the distribution of income and taxes: one (page 28), two, three, four and five (the related NYTimes article) which states, "Governments still collected the same share of total income in 2010 as in 1980 — 31 cents from every dollar — because people with higher incomes pay taxes at higher rates, and household incomes rose over the last three decades, particularly at the top." The #1 article agrees, roughly, saying that total taxes (federal, state and local) equal 30.1% of all income.

5. Campaign funding -- do we need reform?

Tom McClintock spent $1,125,498 in his election against Jack Uppal who spent $51,622, McClintock outspent Uddal by 22 to 1. McClintock received 197,803 votes (61%), Uppal 125,885 (39%). Each McClintock vote cost $5.69, and each Uppal vote cost 41 cents. Each McClintock vote cost 14 times more than a vote for Uppal. In the election of 2012 28% of all campaign contributions came in donations above $10,000. Wealthy Americans funded the election and chose who would run for office. We have the best democracy that money can buy. Our democracy is the servant of the wealthiest who have the money to fund candidates they choose, and ordinary citizens cannot compete. No candidate who would raise the top income tax rates to 90%, to the level they were during the 1940s, 50s, and 60s, can compete because they would never receive backing from the moneyed elite. What do you suggest, Mr. McClintock? Shall we shut down the government in protest?

Read about the details at Open Secrets -- http://www.opensecrets.org/politicians/summary.php?cid=N00006863&cycle=2014

28% of all donations, from just 31,000 donors, in 2012 were in amounts greater than $10,000 according to this web article. Probably half of all donations were in amounts greater than $5,000. Who owns democracy?

6. Unemployment -- how bad is it, and what can be done?

There are still 19 million unemployed. How will you improve the unemployment situtation. The labor force participation rate has dropped to levels of 1978, and all the improvement in the official unemployment rate is due to workers dropping out of the work force.

I wrote all about the unemployment numbers in my most recent essay, directly below this one.

I wrote all about the unemployment numbers in my most recent essay, directly below this one.

If the economy had the same percentage of adults active and participating as it had between 1988 and 2008, then today’s unemployment rate would be 11.9%. (Read the next essay here at this blog) If we had the same LF/P rate as the last four years of Clinton’s presidency, then today’s rate would be 12.7%. Today's 6.7% rate is due to workers dropping out of the labor force.

How will you put people back to work? During the Bush years employment increased only because of the housing bubble that prompted home owners to take out home equity loans. What will drive employers to hire again? Between 2000 and 2011 private sector employment rose by 0%, it did not increase, in December 2000 it was 111,776,000 million and in June of 2011 it was 111,694,000 -- see here. A net zero new employees were added to private sector employment -- private employment came to a halt over 11 years. The working age population increased by over 14%, the private sector employment should also have increased by 14% or 16 million jobs.

Labor force participation is down to the level of the Carter years, January of 1978 -- see here.

Cutting taxes and eliminating government spending in general does not increase economic activity, in fact it retards activity and feeds more unemployment into the population.

See here for article related to this graph. Austerity choked the recovery. Obama's ARRA, passed five years ago, February 17, 2009, improved the economy. My comment to the article:

"I followed the White House fact sheet link to ARRA impact report, 4th quarterly in 2010 --- see here Q2,(http://www.whitehouse.gov/admi... ---

and found that CBO reports ARRA impact was an added 4.6% to GDP growth, JPMorgan Chase reports 3.7% growth impact, Goldman Sachs 2.6%, Moody's Analytics 2.7%, CEA 3.7%. Employment impact was above 2 million."

Almost all economists, even right-wing and Heritage Foundation economists and advocates of greater military spending, acknowledge this dynamic influence of government spending. When Reagan increased spending on military programs it was called “military Keynesianism”, and it worked, the economy improved, look at the graph.

See here for article related to this graph. Austerity choked the recovery. Obama's ARRA, passed five years ago, February 17, 2009, improved the economy. My comment to the article:

"I followed the White House fact sheet link to ARRA impact report, 4th quarterly in 2010 --- see here Q2,(http://www.whitehouse.gov/admi... ---

and found that CBO reports ARRA impact was an added 4.6% to GDP growth, JPMorgan Chase reports 3.7% growth impact, Goldman Sachs 2.6%, Moody's Analytics 2.7%, CEA 3.7%. Employment impact was above 2 million."

Almost all economists, even right-wing and Heritage Foundation economists and advocates of greater military spending, acknowledge this dynamic influence of government spending. When Reagan increased spending on military programs it was called “military Keynesianism”, and it worked, the economy improved, look at the graph.

7. McClintock’s speech -- one can read McClintock’s speeches and view some of them as videos -- see here and here. There one finds some pretty screwy ideas. He said that no study has shown that the Head Start program improves the life outcomes of children, and that Reagan balanced the federal budget, and that the Bush tax cuts helped the economy -- the worst decade economically since the 1930s.

8. Would he eliminate the Federal Reserve Bank?

9. Would he support a financial transaction tax? Why not?

Is there any tax increase he supports?

Our federal government is seriously under-funded. Putting aside Social Security which is funded separately by a payroll tax, in 2012 for the rest of the budget for every $100 spent only $62 were collected in taxes. The remainder, the $38 dollars, was borrowed. Is it really appropriate to advocate a major income tax reduction now? See here, page 25.

10. Would he increase capital gains and dividends tax to pre-Bush levels? The were as high as 35% and then dropped to 15% and now at 20%.

11. Federal taxation is down by $869 billion from the level it was during the Clinton years (in year 2000 tax revenues were at 20.5% of GDP vs year 2011 at 15.1% -- see here, page 27, mostly because of the Bush tax cuts and the Great Recession. The Ryan budget is estimated to cut tax revenues to 15.5% of GDP over the next decade. In contrast the Congressional Progressive Caucus, 1/3 of the Democrats in the House, promotes a budget that would raises taxes to 21.7% of GDP. This difference, 6.2% is equivalent to $992 billion additional tax revenue. Which budget is more realistic? What is wrong with raising the tax burden back to 20% of GDP level, the Clinton years, and gaining another $992 billion in revenue? Obama had to deal with the worst economy in 75 years -- taxes plummetted and government transfers to the needy automatically increased. Federal revenues dropped from 20% of GDP in year 2000 to below 15%, by 5.1% while spending increased by 5.9% of GDP -- this is not a crisis exclusively of spending. Cutting government spending actually makes the crisis worse.

U.C. Berkeley professor Emmanuel Saez recommends a top marginal tax rate of 80% on incomes above $400,000. The last sentence of this article states,

"The job of economists should be to make a top rate tax level of 80% at least "thinkable" again."

"The job of economists should be to make a top rate tax level of 80% at least "thinkable" again."

Obama in his first month passed a $800 billion stimulus program which many economists dismissed as too small and offering too many ineffective tax cuts, and all Republicans opposed the plan. The recession of 18 months ended 4 month after Obama took office and passed the stimulus. It proved inadequate to offset the sharp decline that resulted from the collapse of the credit system, banks going bankrupt, housing foreclosures and so on. Wealth declined by almost 40% for the typical or median income family. Life savings were almost halved. The economy contracted --- people spent less and fewer people were employed. We haven’t recovered, and this is the core problem facing the naton, not balancing out the federal budget.

13. Should the government play a role in the economy beyond enforcing contracts? McClintock has said no, government should have no role in the economy. What will the world look like if and when the McClintock group have succeeded with their revolution? Is the free market capable of fair outcomes? Will people starve, or go without health care, will seniors die on the streets after they spend down their last savings?

_____________________________________________________________

Obamacare Questions -- More Background to Draw On

Over the past 10 years health insurance premium prices have increased by 80% says the Kaiser Family Foundation. The identical policy that cost $10,600 in 2003, now costs $16,351, adjusting all dollar amounts to inflation.

Here's a graph showing the rise in costs since 1999 (Source is here): The 1999 cost, $5,791, adjusted for inflation, becomes $8,097. So prices have more than doubled in 15 years.

The actual cost the article suggests is $22,030 for a family of four.

"According to Milliman’s report, the total cost of $22,030 in 2013 is composed of a total premium for insurance coverage of $18,430, of which the employer is estimated to contribute $12,886 and the employee $5,544. The rest represents out-of-pocket spending of $3,600."

The article concludes:

"The gist of the preceding array of data is that even under what we now call “moderate” growth in health care costs, stagnating incomes for millions of American households will put American health care as we have come to know it out of their financial reach, unless they receive substantial help from households in the upper third or so of the household income distribution."

This is an extreme malfunction illustrating the demerits of the free market system, it has run amok inflicting hardship on all families. During these 10 years wages went up by 31 percent, inflation by 27% and health insurance by 80%. In all, health insurance costs increased by 54%, inflation adjusted. Simultaneously the median family income dropped by $4,000, inflation adjusted; it was $55,108 in 2003, and today it is $51,127. So incomes went down $4,000 while health insurance premiums went up by $5,700. To have the same standard of life the same median family would have had to gain almost $10,000 more income, an income of $61,000 a year, not $51,000.

Here's a graph showing the rise in costs since 1999 (Source is here): The 1999 cost, $5,791, adjusted for inflation, becomes $8,097. So prices have more than doubled in 15 years.

"According to Milliman’s report, the total cost of $22,030 in 2013 is composed of a total premium for insurance coverage of $18,430, of which the employer is estimated to contribute $12,886 and the employee $5,544. The rest represents out-of-pocket spending of $3,600."

The article concludes:

"The gist of the preceding array of data is that even under what we now call “moderate” growth in health care costs, stagnating incomes for millions of American households will put American health care as we have come to know it out of their financial reach, unless they receive substantial help from households in the upper third or so of the household income distribution."

This is an extreme malfunction illustrating the demerits of the free market system, it has run amok inflicting hardship on all families. During these 10 years wages went up by 31 percent, inflation by 27% and health insurance by 80%. In all, health insurance costs increased by 54%, inflation adjusted. Simultaneously the median family income dropped by $4,000, inflation adjusted; it was $55,108 in 2003, and today it is $51,127. So incomes went down $4,000 while health insurance premiums went up by $5,700. To have the same standard of life the same median family would have had to gain almost $10,000 more income, an income of $61,000 a year, not $51,000.

Health expenses for the median family amount to about 1⁄4 of all expenses. Total expenses register at $63,000 with health care expenses at $16,000. (From epi.org, basic family budget calculator, see here) This family budget calculator surveys normal living costs for 615 geographical regions incorporating four sizes of families, for a total of 2,460 different budgets.

Presently we have rationing of health care, we ration it by price and income.

15% of the nation go without health insurance.

20%, receive it medical attention through the Medicaid system, and

15%, receive Medicare.

about 50% have private health insurance coverage.

No other advanced country goes without universal coverage.

Health care is more than a market commodity, it is a humanitarian need, a mark of decency and civility in a society. The Kaiser Family Foundation reports that 53% of Americans put off medical care because of the high expense, 70% among families with incomes below $40,000, which is about 40% of all U.S. citizens.

Our system is over-priced, it costs us the equivalent of 17% of GDP per year. Most countries manage without half that share amount. We spend $8,508 per human per year, the average for the other 33 countries in the OECD is $3,339; meaning we pay 2 and a half times more, they pay 60% less than Americans do. Our care ranks around 37th in the U.N. World Health Organization index.

The Obamacare improves health coverage because it 1) makes it illegal for health insurance companies to arbitrarily cancel your health insurance just because you get sick, 2) requires companies to cover people with pre-existing conditions, 3) ends lifetime and yearly dollar limits on coverage, 4) holds companies accountable for rate increases, 5) covers young adults under 26, 6) provides free preventive care, and 7) protects your choice of doctors.

There are 47 million Americans that go without health insurance, and the Obamacare system would reduce that by one half. http://healthaffairs.org/blog/2013/06/06/the-uninsured-after-implementation-of-the-affordable-care-act-a-demographic-and-geographic-analysis/

In Topeka, Kansas, there lives the median family with expenses exactly in the middle for a family according to the Economic Policy Institute's web page The Basic Family Budget Calculator. Last year its overall expenses for a modest lifestyle was $63,000 and 1⁄4 of the cost was for health insurance. About $16,000 for a family of four is the middle expense to families for health insurance. This also accords with the National Council of State Legislatures that states "Annual premiums for employer-sponsored family health coverage reached $16,351 this year."

From the National Council of State Legislatures (http://www.ncsl.org/research/health/health-insurance-premiums.aspx), “Annual premiums for employer-sponsored family health coverage reached $16,351 this year, up 4 percent from last year, with workers on average paying $4,565 toward the cost of their coverage, according to the Kaiser Family Foundation/Health Research & Educational Trust (HRET). During the same period, workers' wages and general inflation were up 1.8 percent and 1.1 percent respectively. This year's rise in premiums remains moderate by historical standards. Since 2003, premiums have increased 80 percent, nearly three times as fast as wages (31 percent) and inflation (27 percent). "We are in a prolonged period of moderation in premiums, which should create some breathing room for the private sector to try to reduce costs without cutting back benefits for workers," Kaiser President and CEO Drew Altman, Ph.D., said. Released Aug. 20, 2013. SEE: 2013 Employer Health Benefits Survey.

_______________________

The Republican alternate plan

In September, 2013, the Republican Study Committee released a medical health reform bill, see here.

Bloomburg carried an article.

McClintock and 170 other Reps support this new bill.

In March 2010 the ACA was passed, in August 2013 Newt Gingrich chastised the Republican Party for having no alternative.

Why were the Reps so slow with an alternative?

Wikipedia has an entry on the ACA.

The Republican alternate plan

In September, 2013, the Republican Study Committee released a medical health reform bill, see here.

Bloomburg carried an article.

McClintock and 170 other Reps support this new bill.

In March 2010 the ACA was passed, in August 2013 Newt Gingrich chastised the Republican Party for having no alternative.

Why were the Reps so slow with an alternative?

Wikipedia has an entry on the ACA.

_______________________

I hope some of the readers can help out with more and better questions. And I hope we can put some intelligent thought provoking ideas into the public discussion.

Ben Leet, January 26, 2014